SiriusPayroll365 FAQs

How do I install Sirius Payroll 365?

For more information, please refer to our Sirius Payroll 365 Setup Guide.

For more information, please refer to our Sirius Payroll 365 Setup Guide.

Does Sirius Payroll 365 support employee self-service?

To unlock the full potential of Sirius Connect 365, please contact our sales team.

Can additional pension contributions be made apart from the regular pension contribution?

Can salary sacrifice contributions be created separately from other contributions?

Is the P32 report automatically generated by the system?

Can I exclude employees with zero net pay from the payroll batch so that FPS can be sent without including them?

How do I know that the Final Submission for the year has been sent to HMRC?

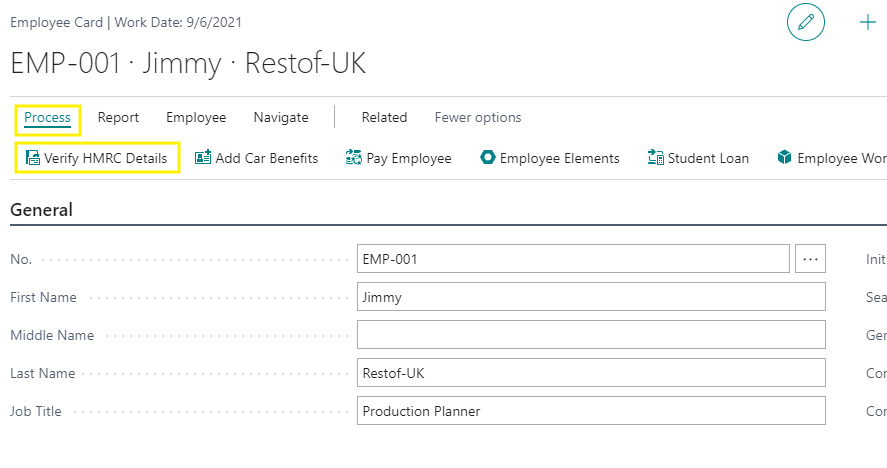

How can I get RTI updates from HMRC?

How frequently is Sirius Payroll 365 updated?

Where will updates from HMRC and new system features be communicated?

Additionally, a follow-up reminder email will be sent within a week to ensure no update is missed.

What if the user doesn’t want to post G/L entries?

How can Business Central be integrated with Payroll?

Can draft payslip be generated and send for verification to employee?

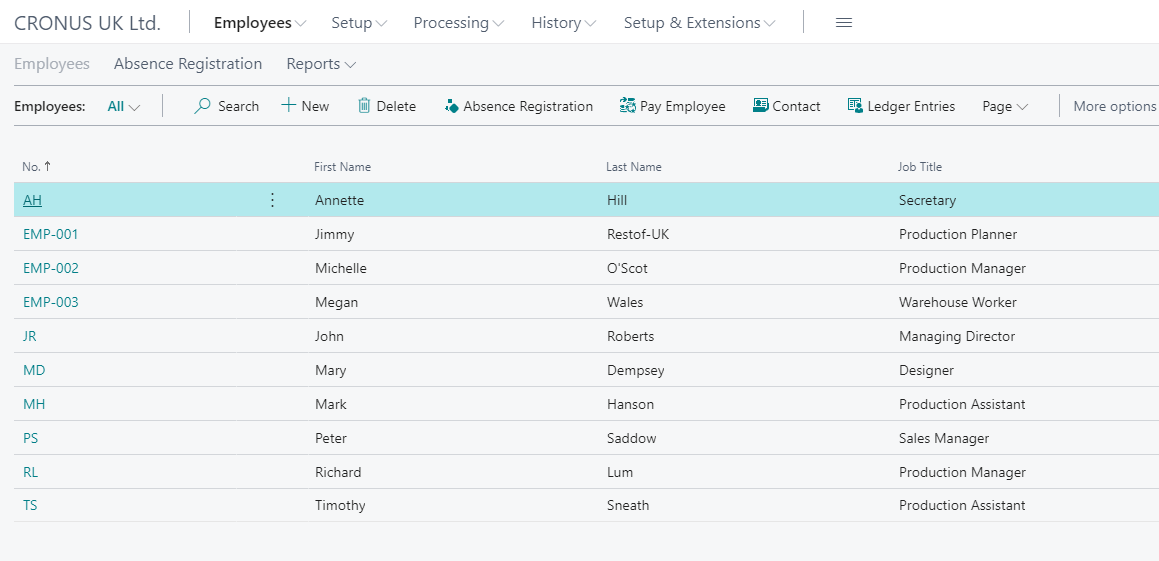

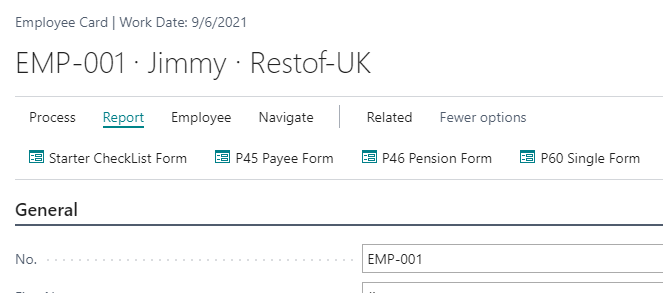

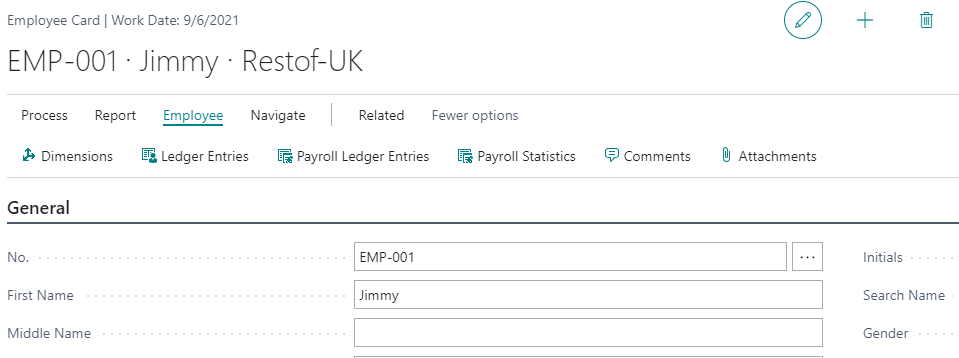

Does Sirius Payroll 365 use the standard Employee table within Business Central?

How do I auto-enroll a new member of staff?

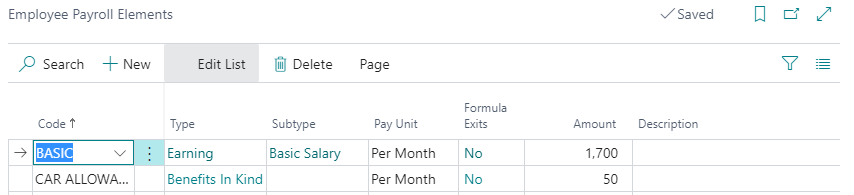

How is car allowance calculated?

For Benefits in Kind, tax is calculated, but the car allowance amount is not included in the employee’s Net Pay. Since there is no cash transaction, you do not need to map it to G/L Accounts.

However, if you wish to offer it as a cash benefit, you will need to define such payroll element as earning and link it to corresponding G/l Accounts.

How do I import historical transactions, so the calculations are shown correctly?

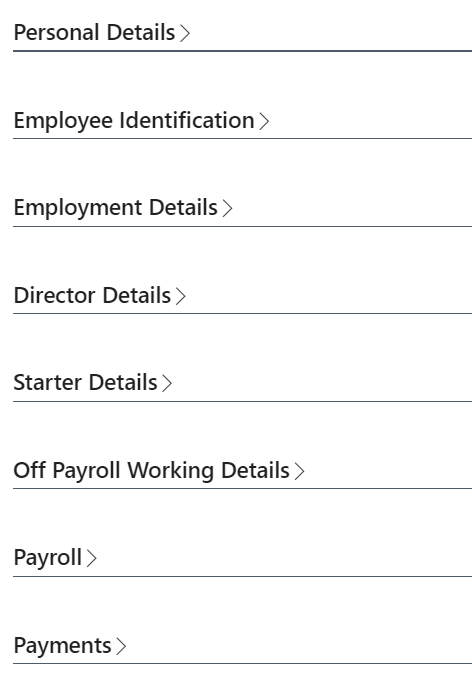

How much data can I hold about each employee?

You can store the following information for each employee:

- General information

- Picture & Attachments

- Address information

- Employment information

- Personal information

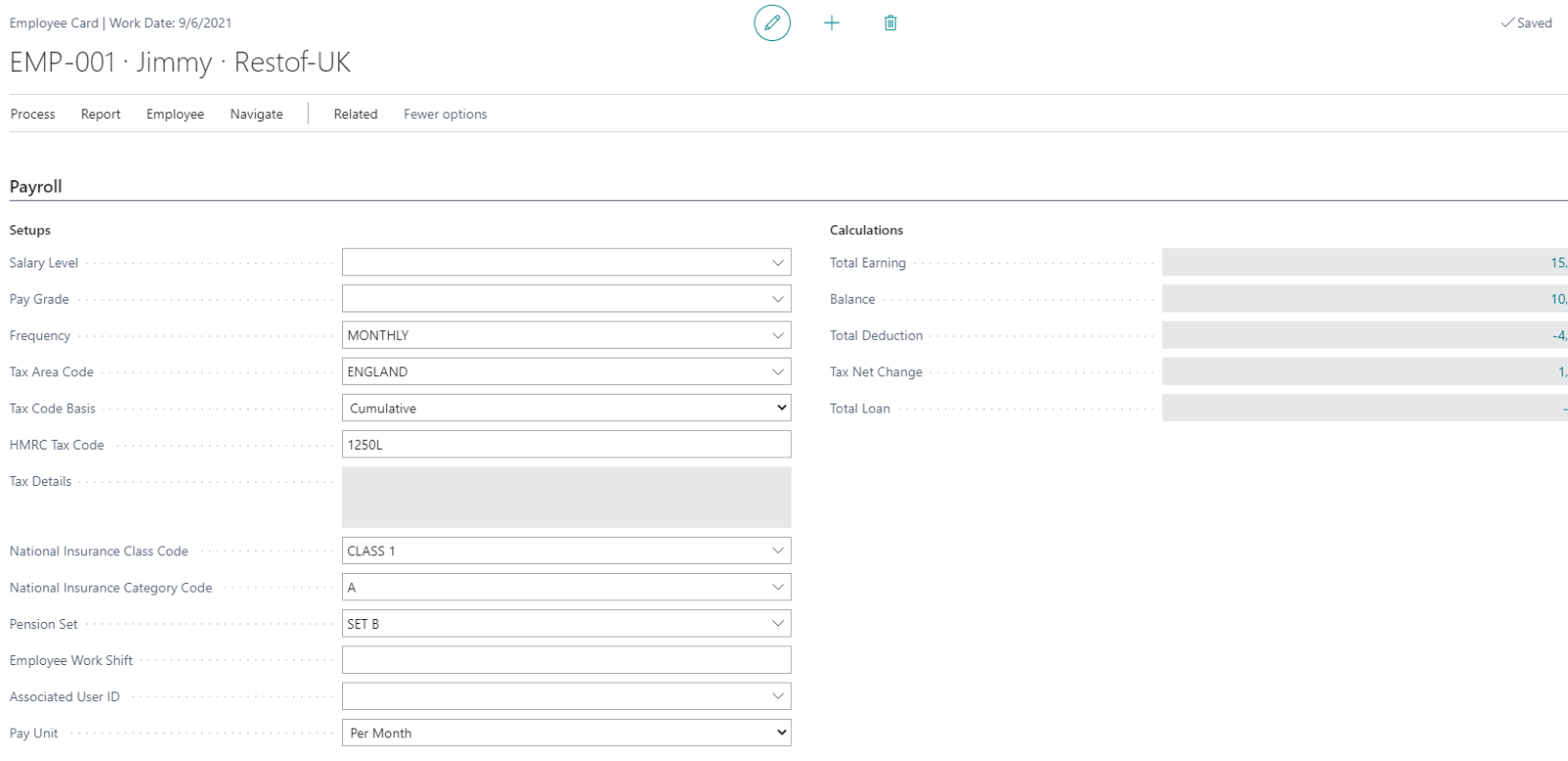

- Payroll information

- Payment / banking information

- HMRC starter / payroll information

- Confidential information

- Absences

- Contact

- Qualifications

- Reporting Dimension

- Misc. Information

- Pay Elements

- Timesheet entries

- Car benefits

- Student Loan

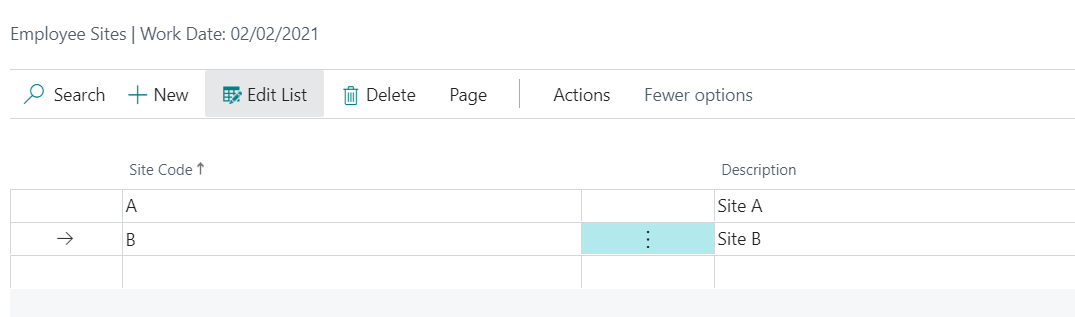

- Worker locations

You can also configure additional fields as needed.

Once I submit the monthly reports to HMRC, does the payroll solution integrate with Business Central?

I currently pay uplifts to consultants and calculate holiday entitlement based on those uplifts manually in Excel. Can Sirius Payroll 365 handle this?

How does Sirius Payroll 365 work with the on-premise version of Dynamics NAV/Business Central?

Overview:

- Extract data from on-premise NAV/BC: Includes Employee records, Dimensions, and Chart of Accounts.

- Import and configure data in Sirius Payroll 365 (hosted on Business Central SaaS).

- Run payroll and post results in Sirius Payroll 365 OnCloud.

- Export payroll journals and import them back into Dynamics NAV/BC as General Journals.

Here are the steps you will need to follow to make sure Sirius Payroll 365 works for on-premise version of NAV/BC:

STEP 1: Set-up BC Cloud

- Configure Business Central SaaS in the cloud.

- Dual-use rights are available with new CSP licences.

- If not, you will require at least one Business Central Essentials CSP licence.

- Install Sirius Payroll 365 from Microsoft AppSource.

STEP 2: Set Up Core Data

- Extract Chart of Accounts, Dimensions, and Employee data from your on-premise NAV/BC system.

- Import this data into the Business Central SaaS environment.

- Optional setup support available: 1-day service at £1,000.00.

STEP 3: Configure Payroll

- Define Payroll Elements.

- Set up Payroll Configuration.

- Configure Employee details for payroll processing.

STEP 4: Execute Payroll

- Create and set up a payroll batch.

- Approve payroll.

- Export payroll journals via the Sirius Payroll 365 app.

- Import payroll journals into Dynamics NAV On-Premise as General Journals.

Note: The Sirius Payroll 365 app supports all NAV versions starting from March 2021. In the meantime, manual import can be supported by our team, if required.

Ongoing Monthly Process:

- Review and update Employee data as needed.

- Repeat Steps 3 and 4 for each payroll cycle.

Does Sirius Payroll 365 support P11D?

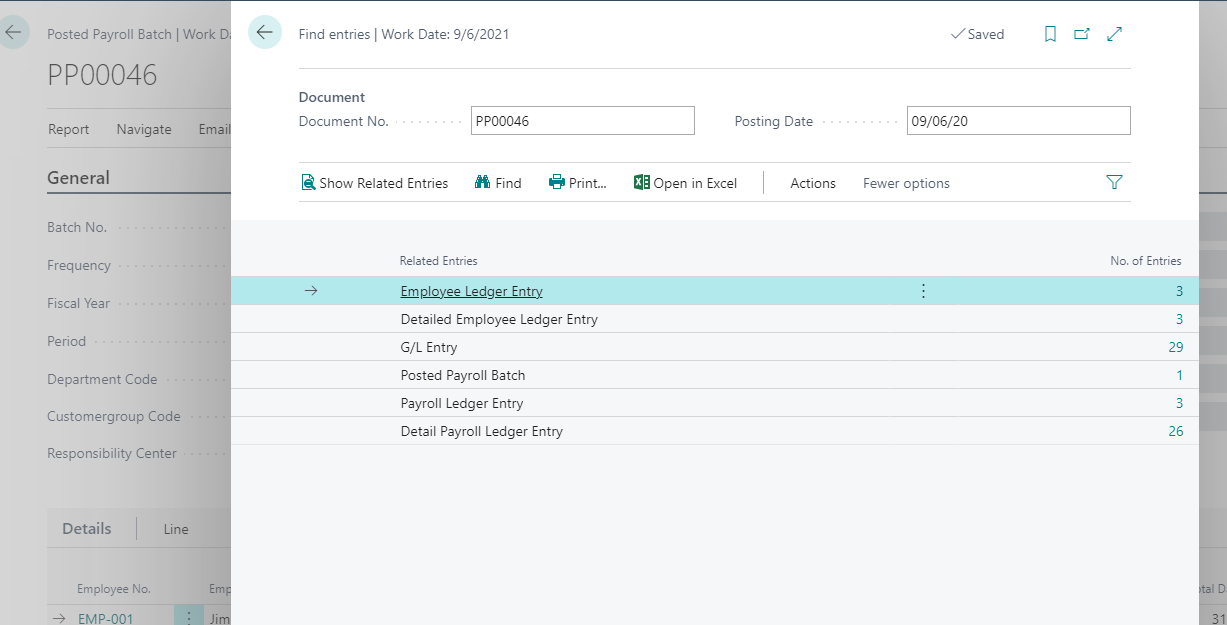

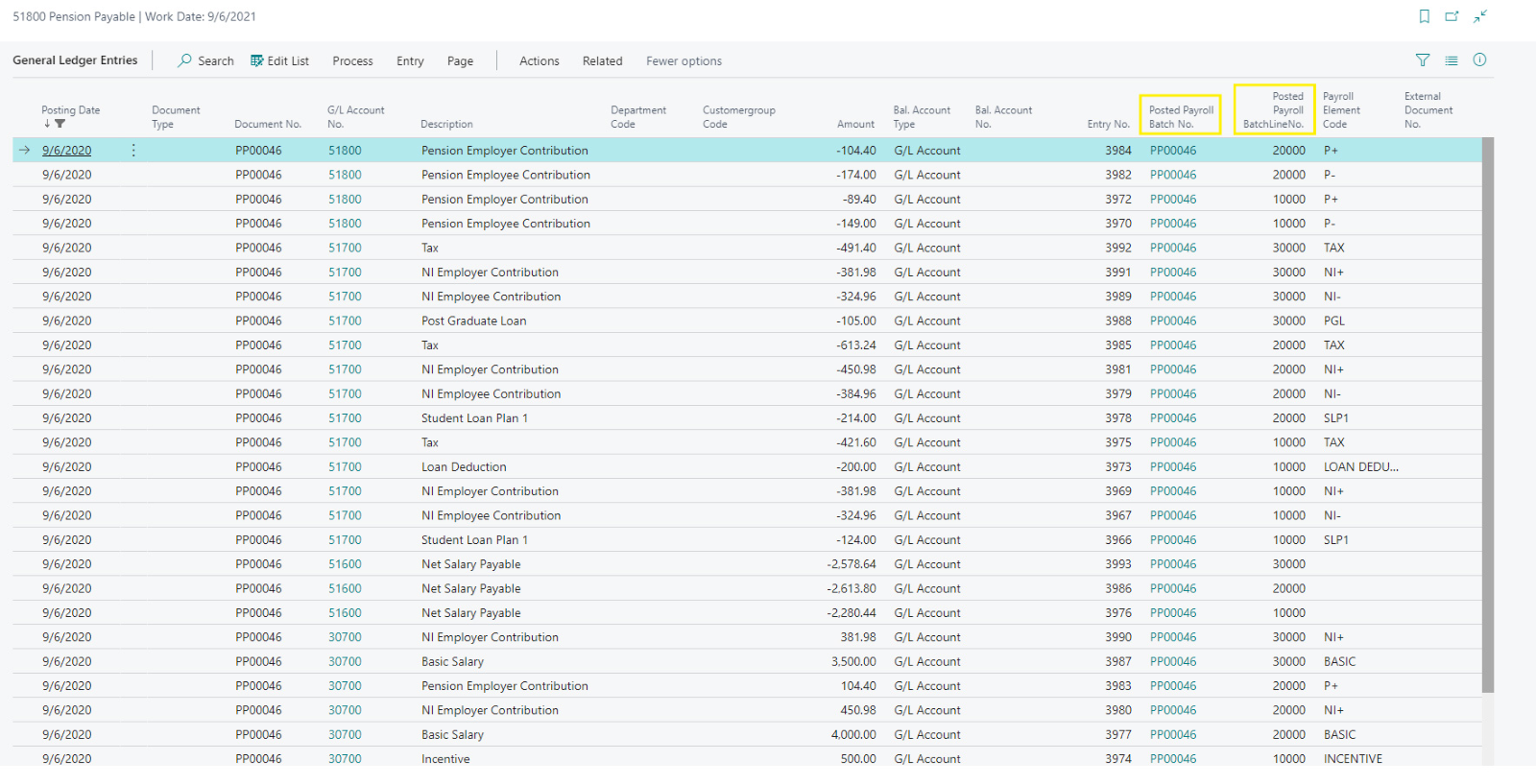

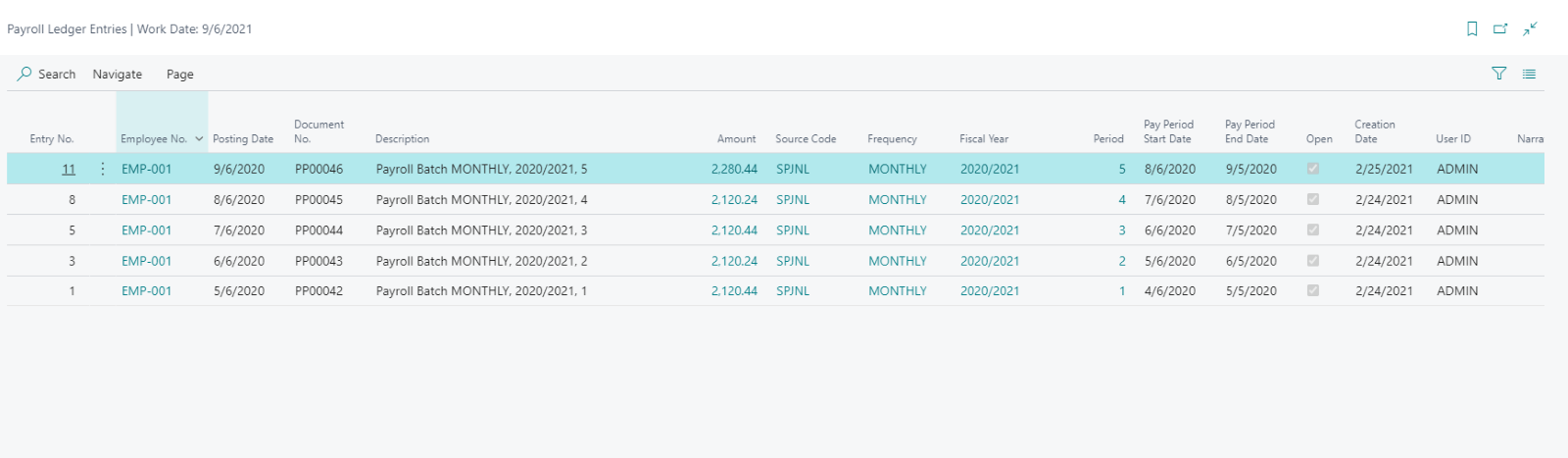

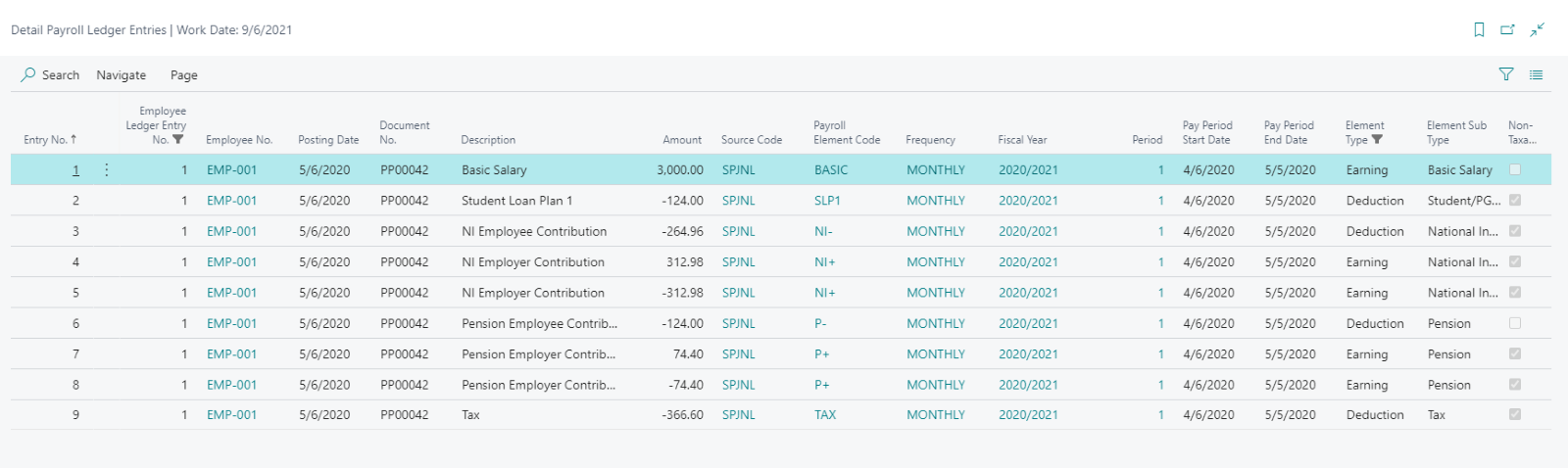

When are the payroll ledger entries created? Do you just post them?

- Payroll Ledger Entries

- Employee Ledger Entries

- General Ledger Entries

You can view these via “Find Entries” in the Posted Payroll Batch screen.

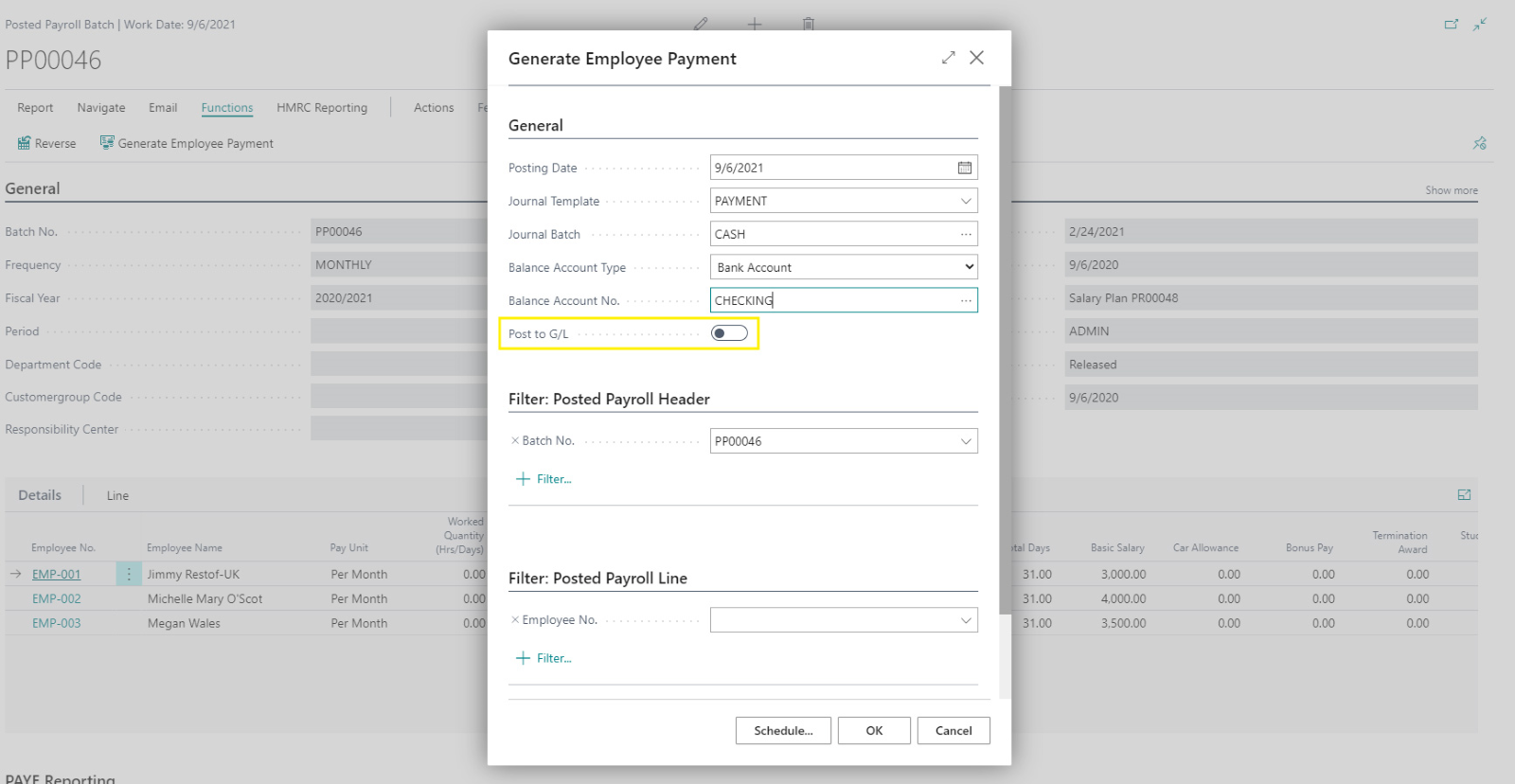

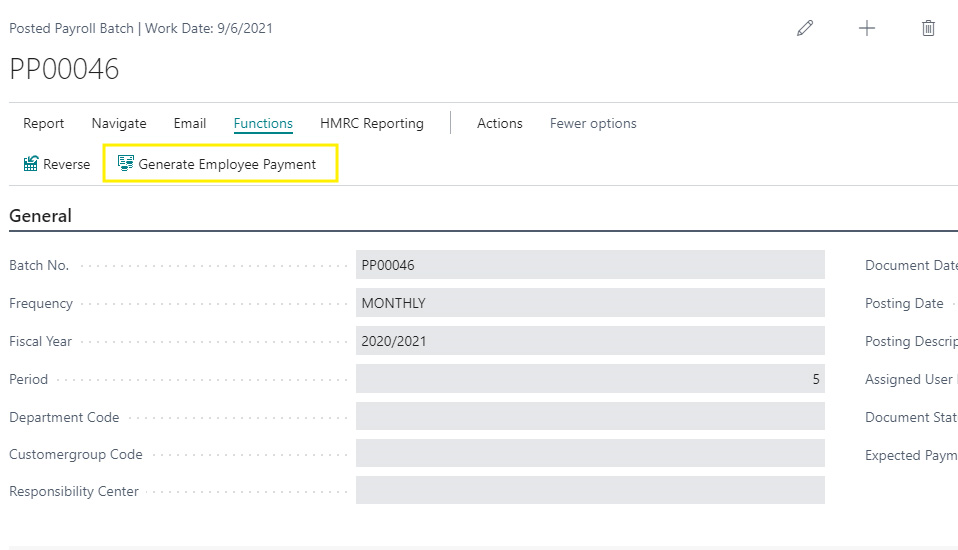

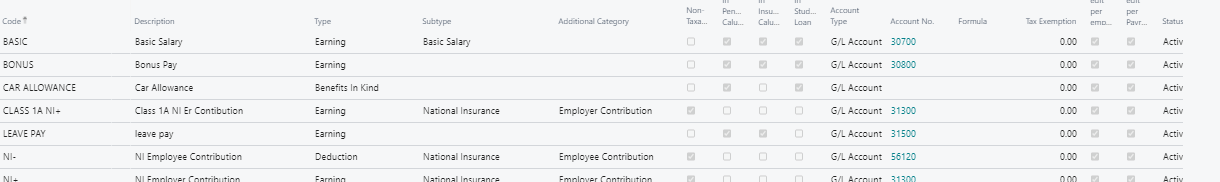

Fill in the required details as show in the screen shot below. Then click on “OK”.

This will create the payment journal of all the employees posted in the selected Posted payroll plan.

If you want to directly post it to general ledger entries, enable “Post to G/L”. Disabling it will only create the journal lines.

Does Sirius Payroll 365 create payroll payment journals?

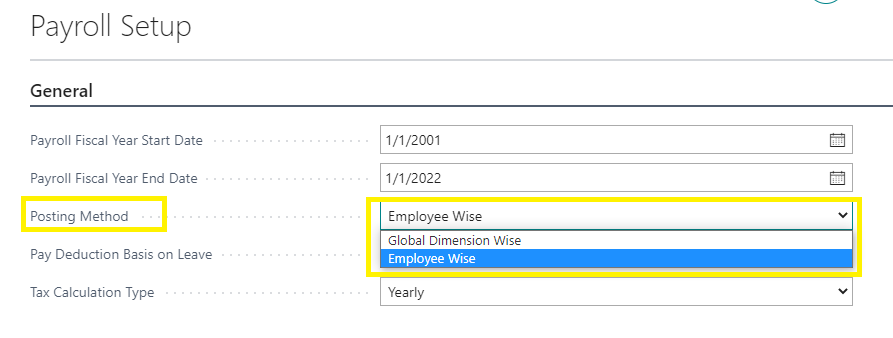

Can payroll entries be tracked per employee in the general ledger, i.e., can it be tracked from a reconciliation point of view?

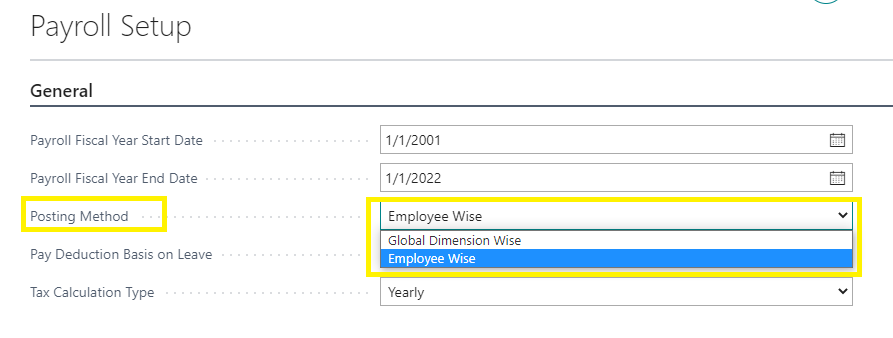

For employee-wise tracking, set the Posting Method to Employee-wise. Use Posted Payroll Batch No. and Line No. to trace G/L entries.

What tasks must be completed at the end of a payroll period?

- Process BACS payments, submit FPS, EPS to HMRC, generate pension reports for pension providers, and other reports as appropriate.

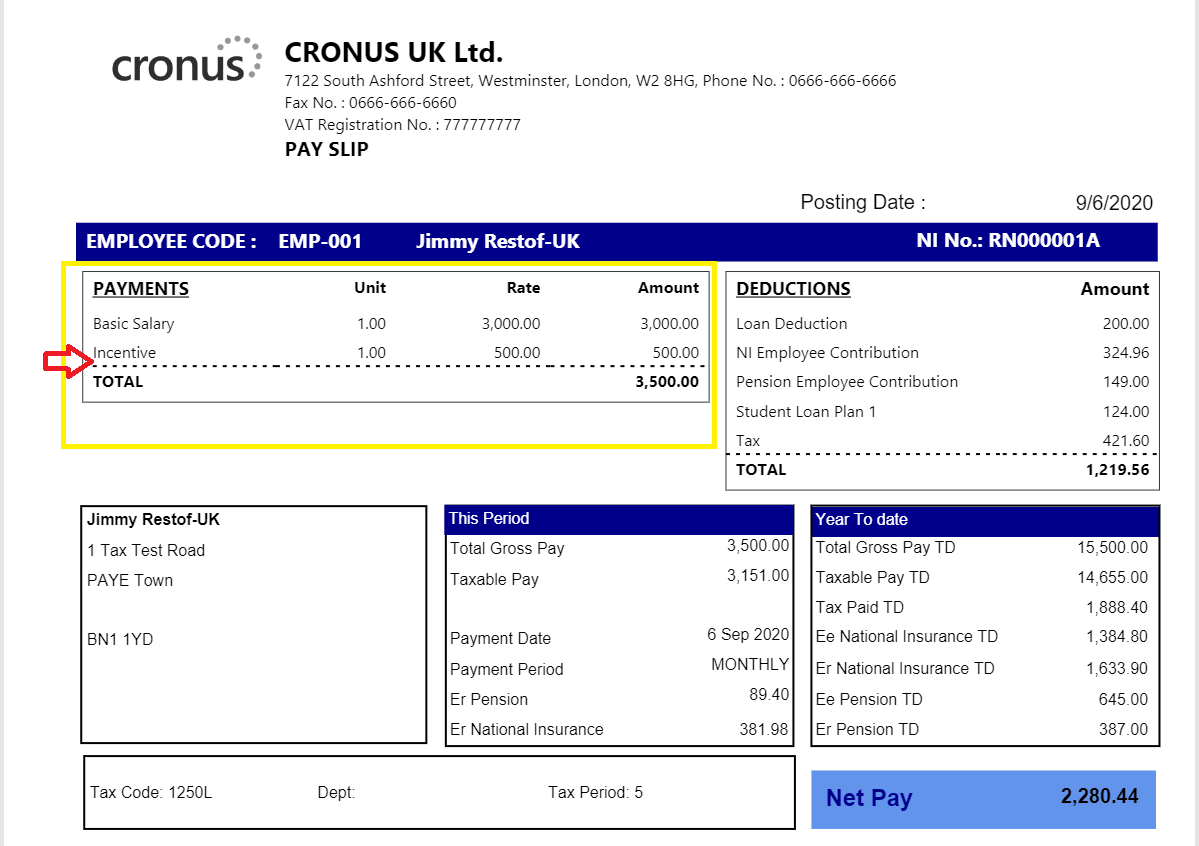

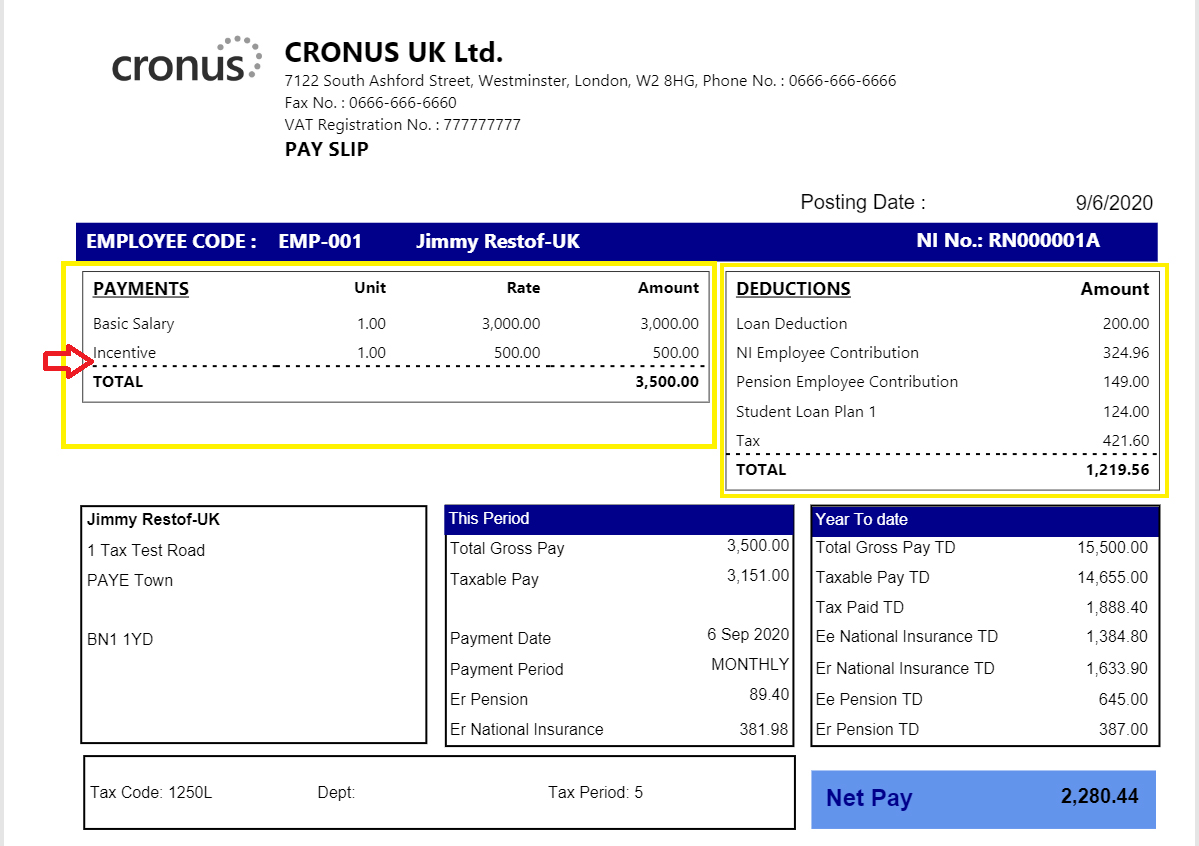

Do additional earnings appear on the payslip?

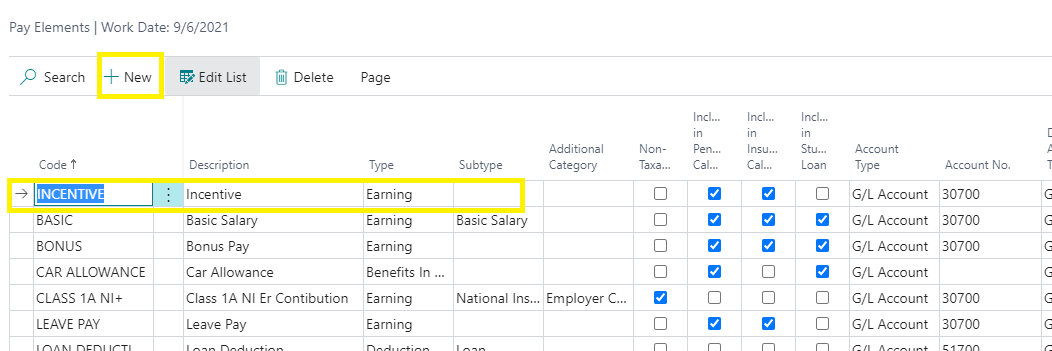

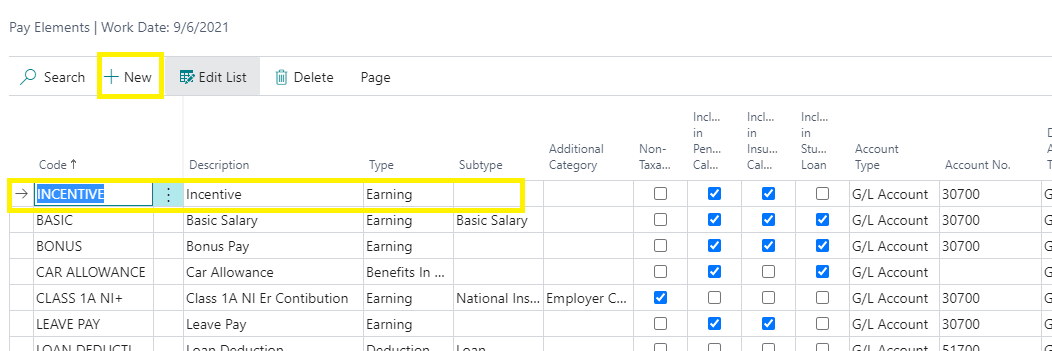

- For this, add the additional earnings or benefits in Pay Elements with Type “Earning”.

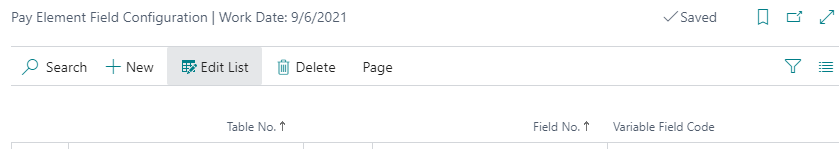

- Configure Pay Element Field Configuration to appear in the payroll batch.

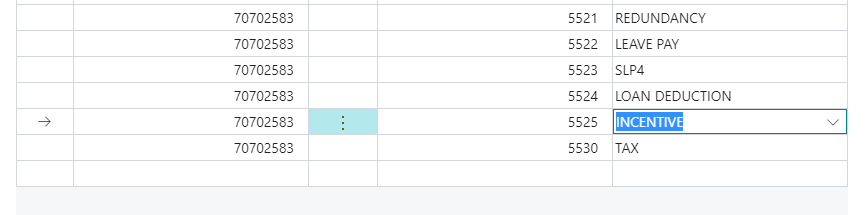

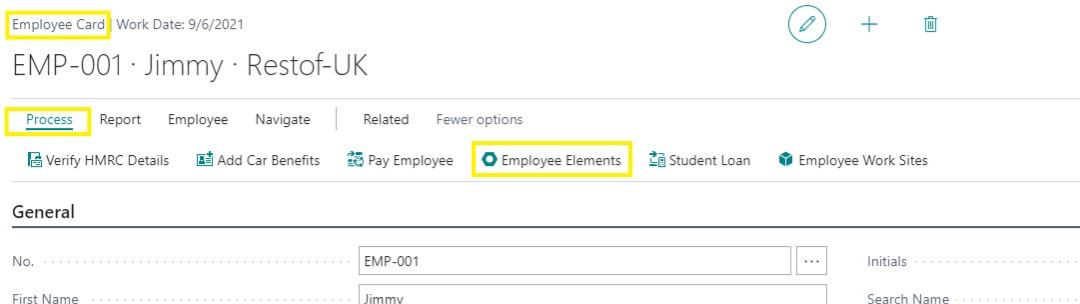

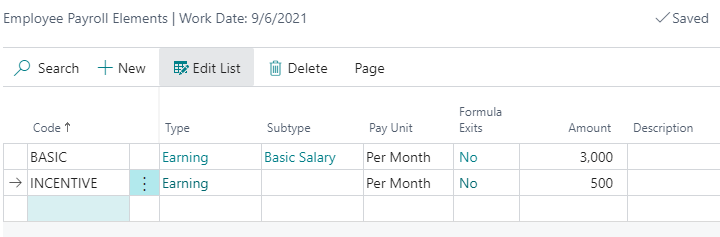

- Add the Pay Element and the Rate in the Employee Card.

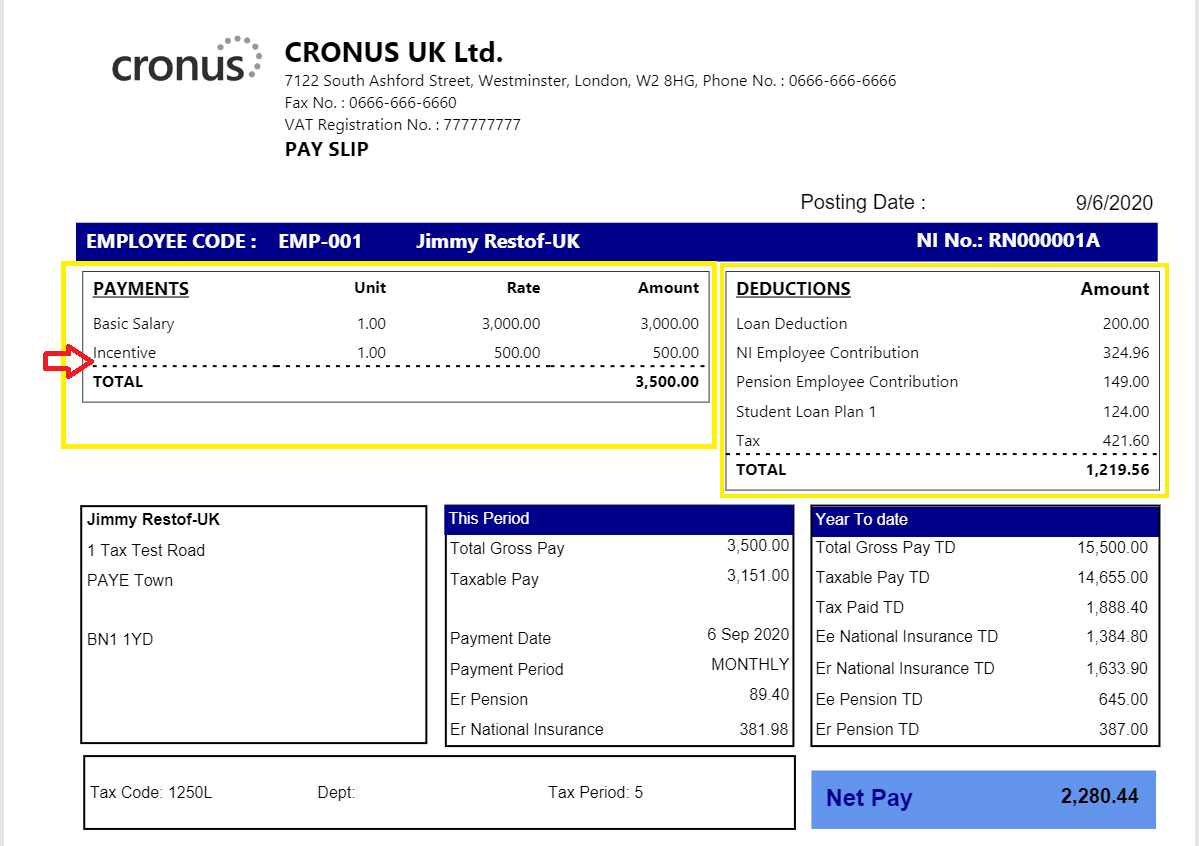

The posted earnings appear in the payslip as show below in the in the payment section.

The posted earnings appear in the payslip as show below in the in the payment section.

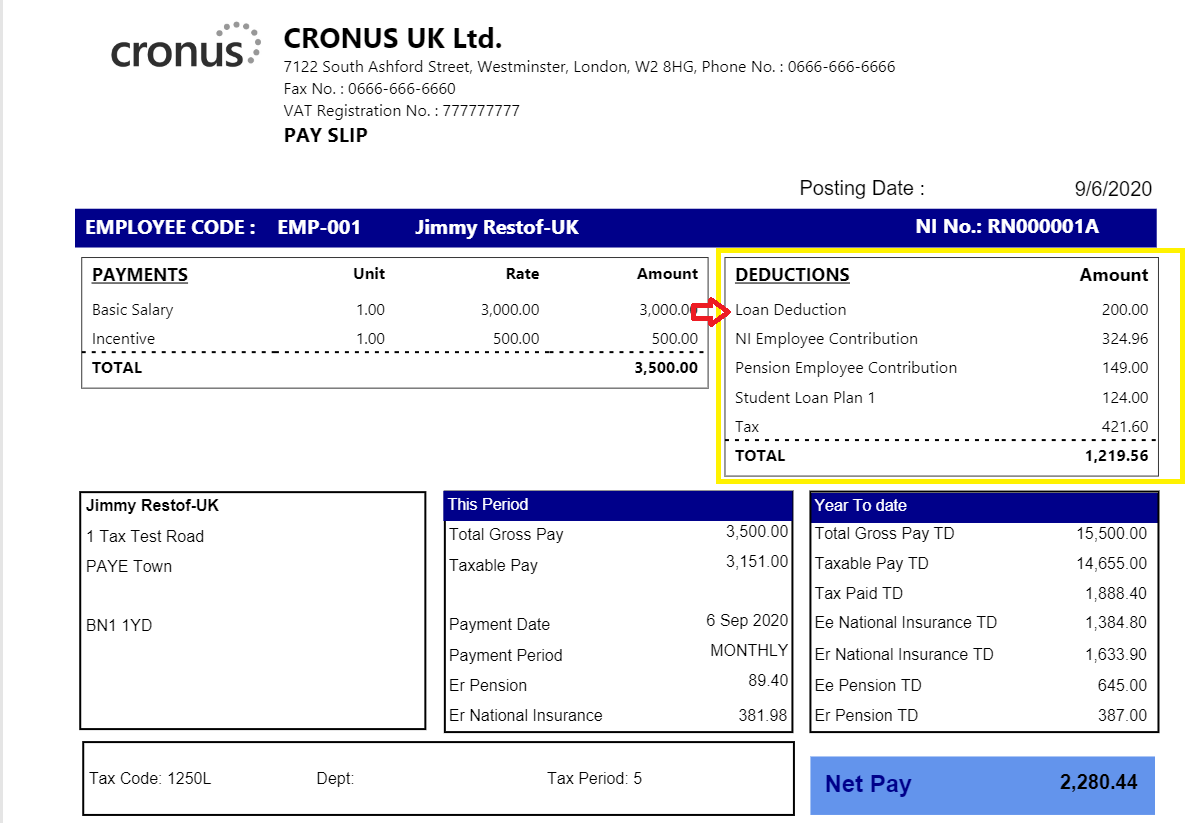

Do additional deductions appear on the payslip?

For this, add the deduction in Pay Elements with Type “Deduction”.

Once it is configured, process the payroll batch and post it. It will appear in the Deductions section on payslip as shown below.

Can employees access past payslips?

Sirius Payroll 365 is automatically connected to Sirius Connect 365, which employees can log into using their email ID.

To unlock the full potential of Sirius Connect 365, please contact our sales team.

How many pay elements can be displayed on the payslip ?

How many deductions can be displayed on the payslip ?

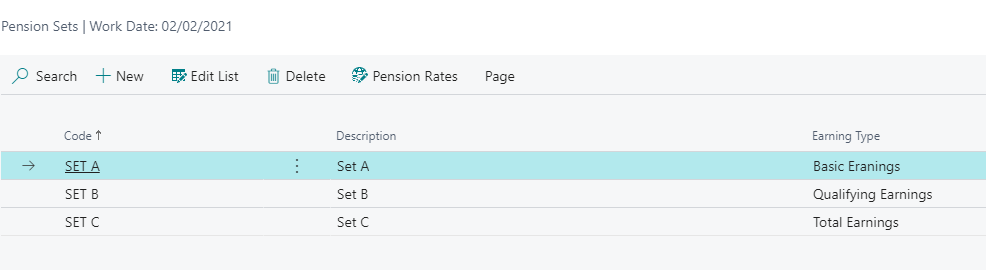

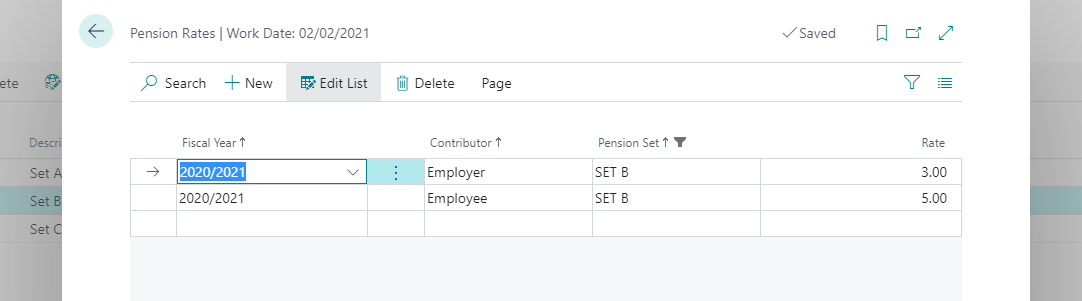

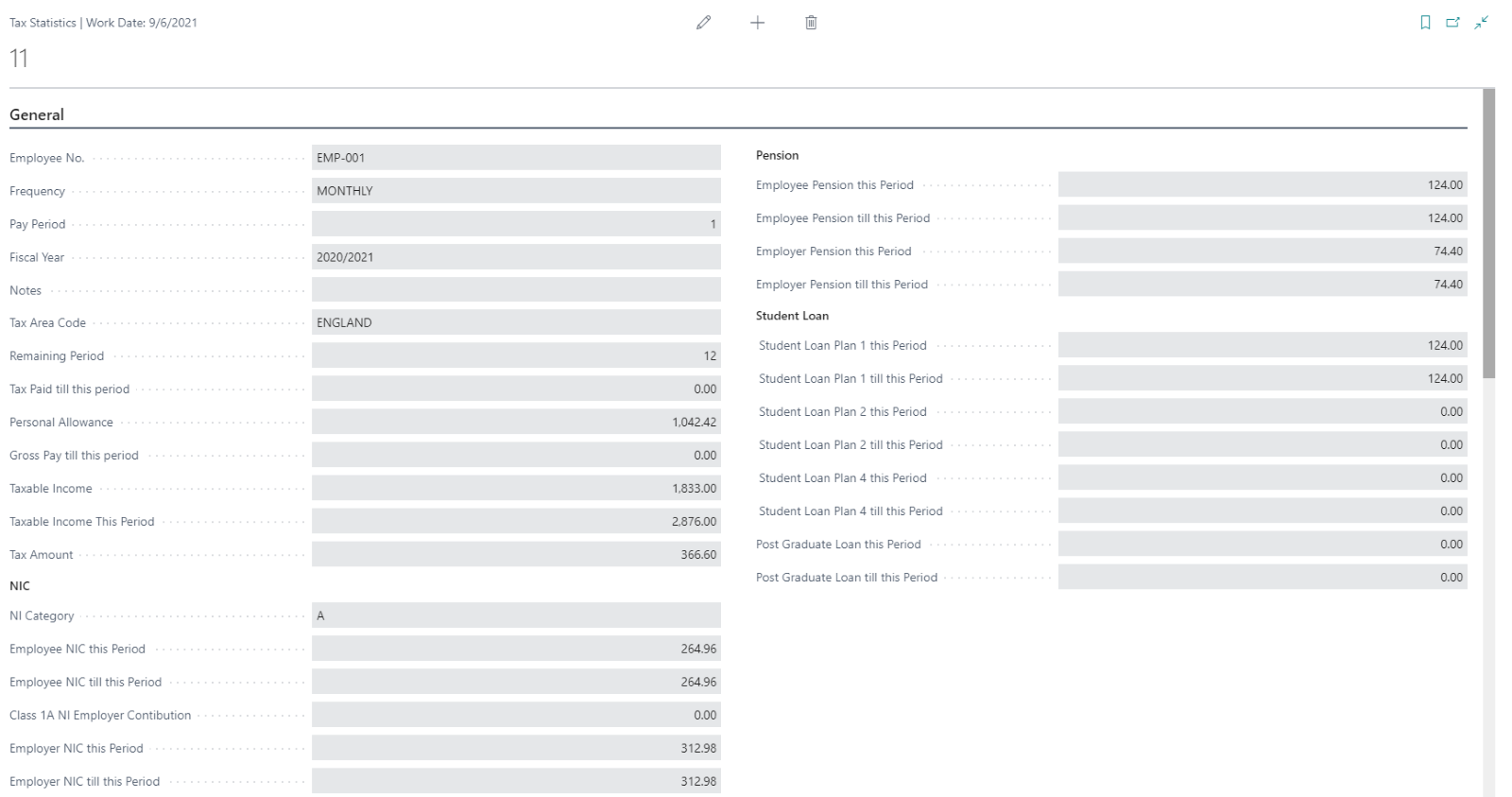

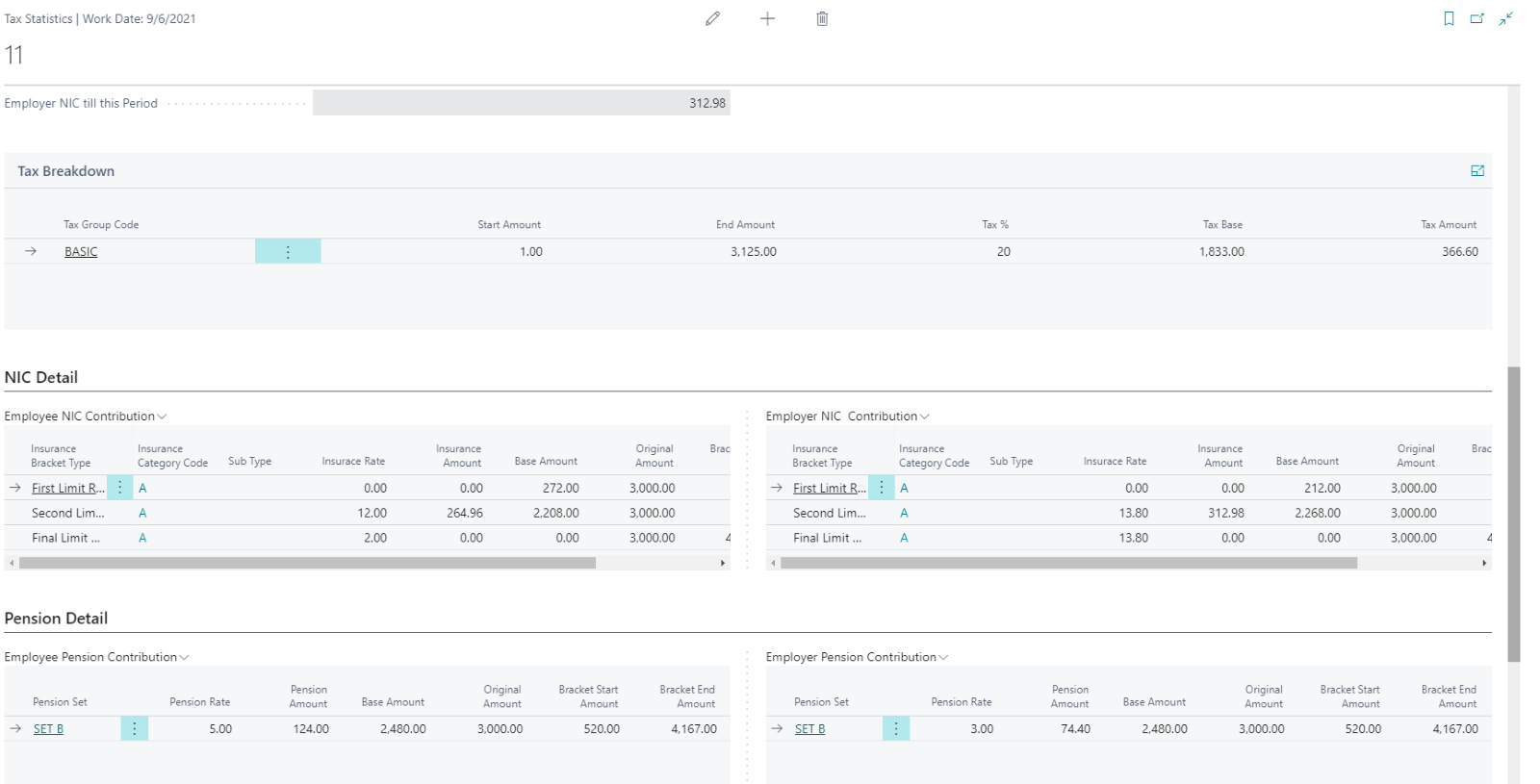

How are pensions calculated? Does it calculate the 3% or 5% automatically?

- Basic Earnings

- Qualifying Earnings

- Total Earnings

Define Contribution Rates, and the system will calculate automatically.

Can I get a pension provider extract?

Pension elements can be mapped to either a Vendor or G/L Account, depending on how you manage your Pension Provider.

Data can be extracted from the General Ledger, Vendor Ledger, or both. Use the Payroll Detail Ledger for individual employee contributions.

For Pension Provider report, data export field setup can be configured as per Pension provider template and such report can be extracted from Posted payroll batch with Export pension tab.

How do I hide salary info from bookkeepers?

How are expenses shown in the accounts?

Each pay run generates a payroll journal that debits expenses and credits liabilities like PAYE, NIC, pensions, student loans, etc.

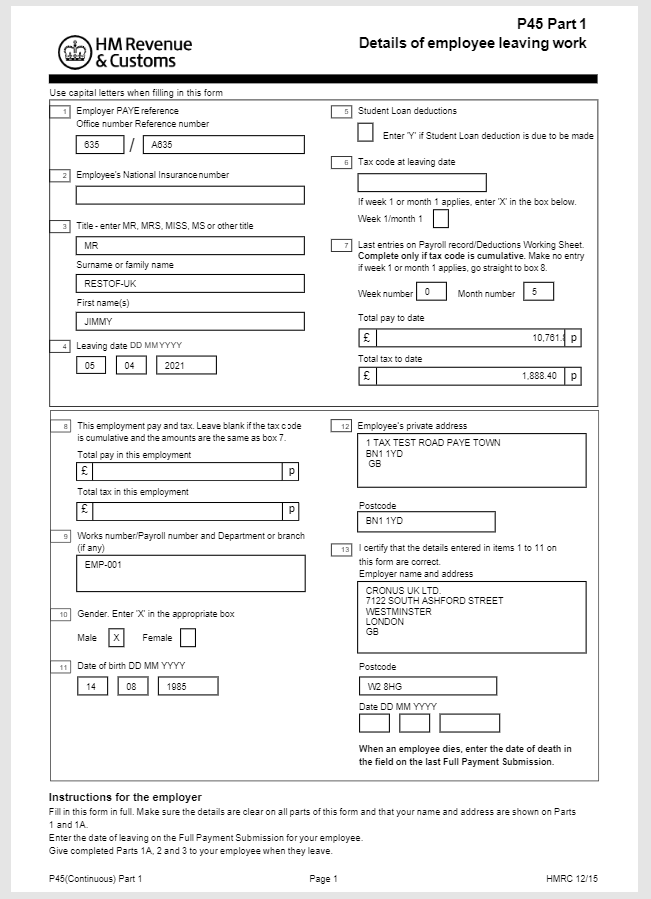

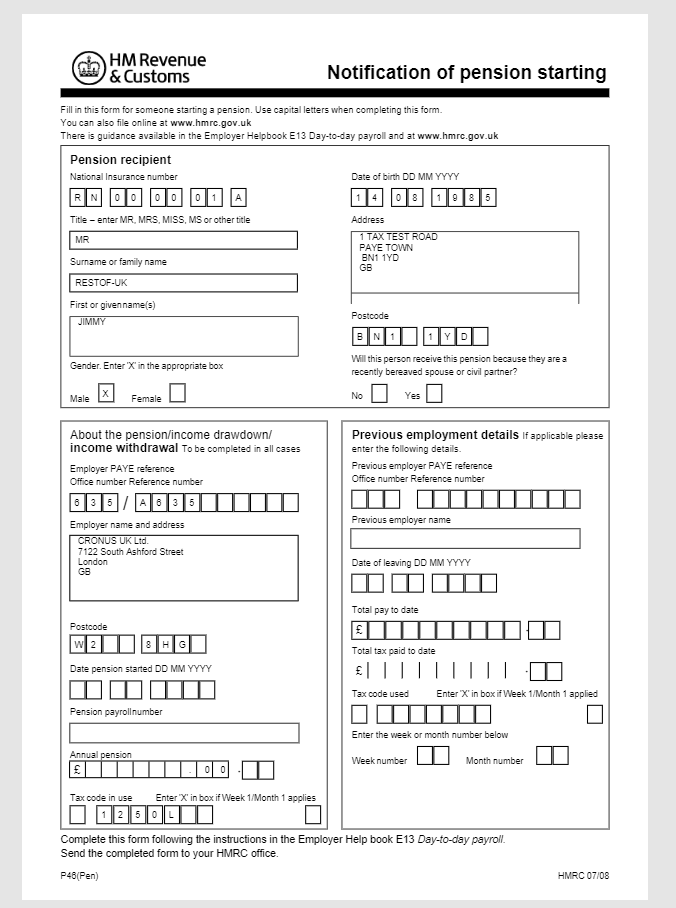

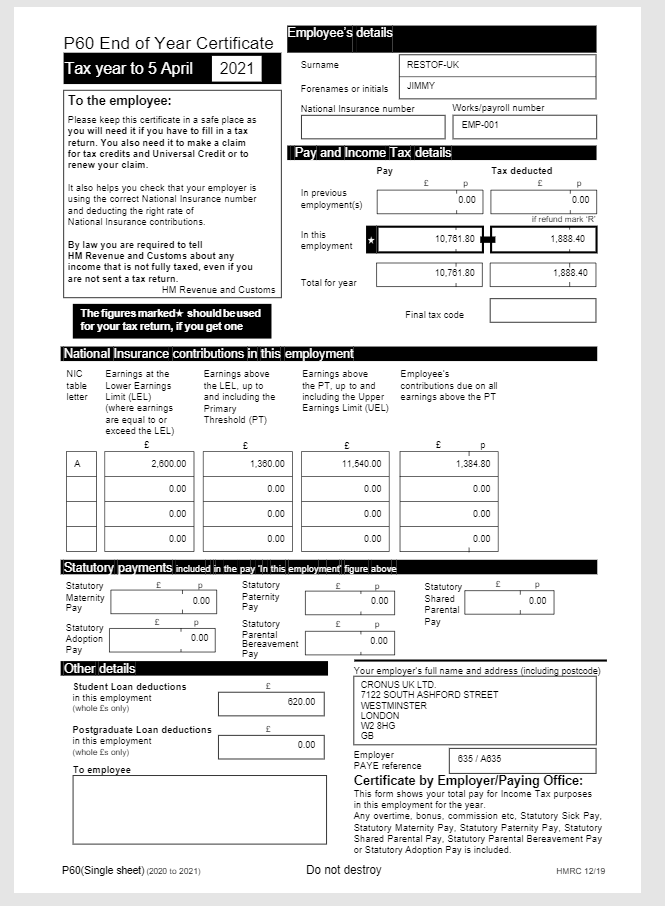

What reports are available out of the box ?

- Employee Payslip (both Draft and Final payslip)

- Userd can print the HMRC related forms from employee card.

- P45

- P46

- P60

- Payroll Statistics & Ledger Entries on the Employee Card

- Payroll Ledger and Detail Ledger entries

- Employee Payroll Statistics

- BACS Report

- Pension report

- Pre and Post Payroll Summary

- Comparison Period Report

- Cheque Payment report

- Vendor Remittance advice report

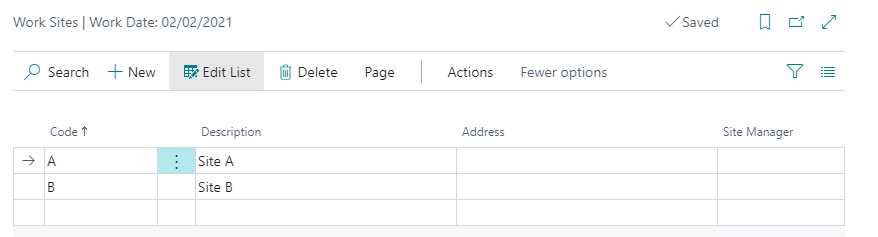

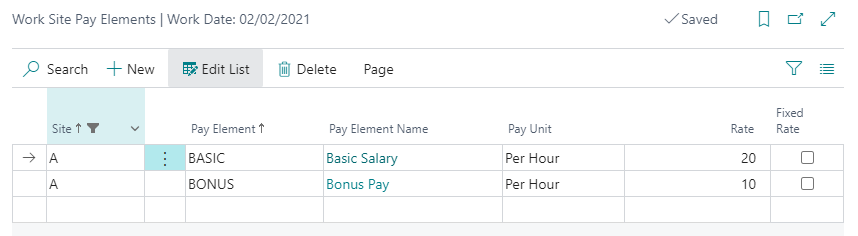

Can you enter timesheets?

(Sirius Payroll 365 has both fixed and flexible rate timesheet configuration)

How are timesheets mapped to payroll?

Is pricing based on employees or pay runs?

What is the cost per employee?

Is £1.00 per employee per month a moving scale?

Are there training videos available to help the set-up?

Yes, we offer an interactive simulation of Sirius Payroll 365, including:

- Video walkthroughs

- Configuration guidance

- App navigation

Do you provide support?

We also provide:

- Training documentation (.pdf/.docx)

- PowerPoint slides for classroom use