SiriusPayroll365 FAQs

How do I install SiriusPayroll365?

For more information you can visit our setup guide: https://www.siriusapp.co.uk/apps/siriuspayroll365-hmrc-payroll/documentation/

For more information you can visit our setup guide: https://www.siriusapp.co.uk/apps/siriuspayroll365-hmrc-payroll/documentation/

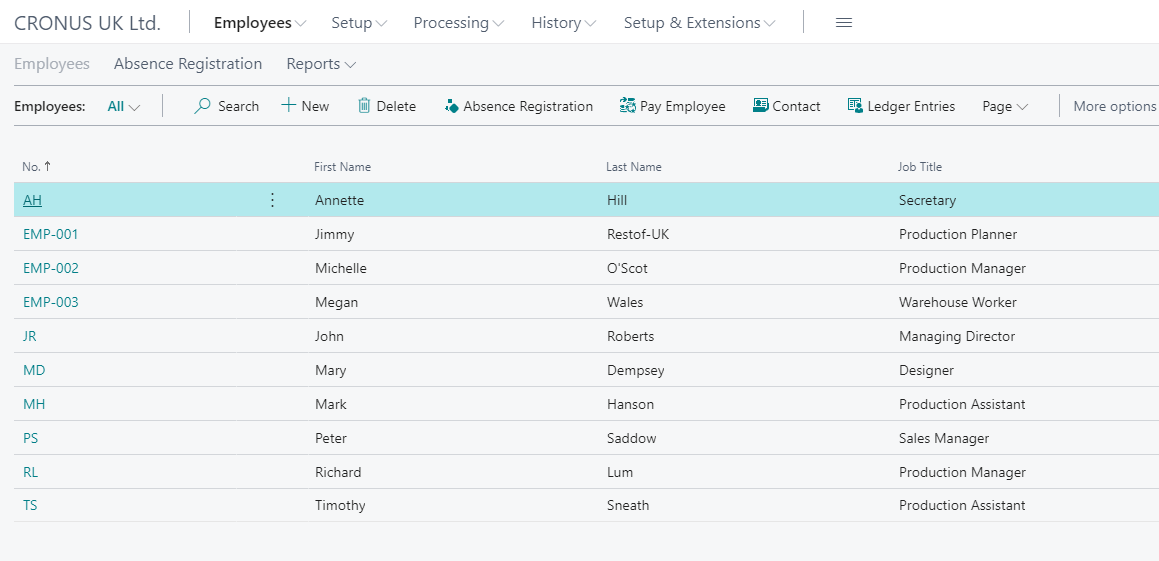

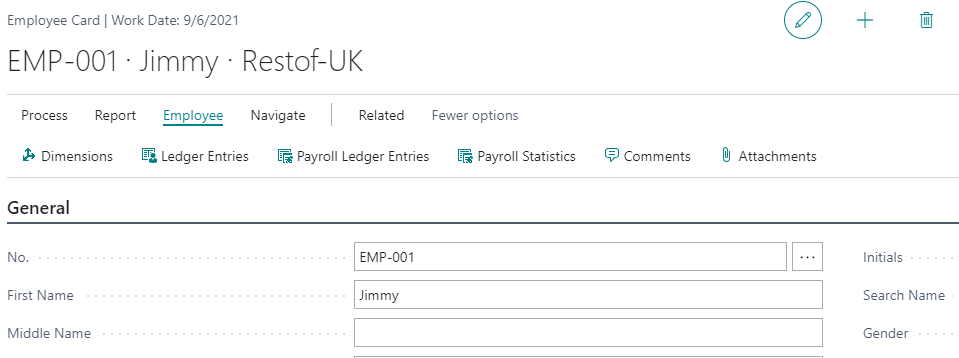

Does SiriusPayroll365 use the standard Employee table within Business Central?

How do I auto enroll a new member of staff?

How is Car allowance calculated?

How do I import historic transactions? So, the calculations part is shown correctly?

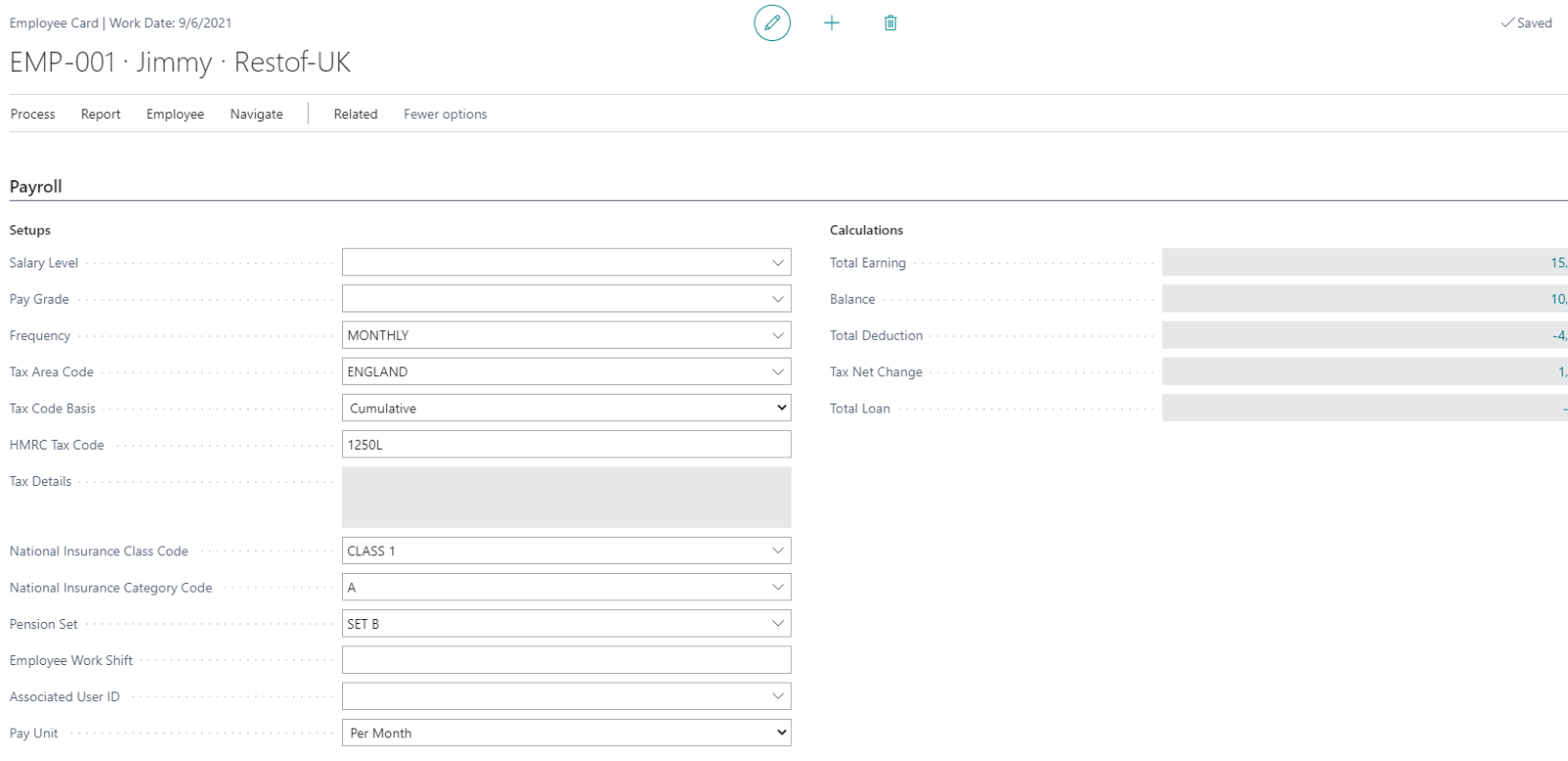

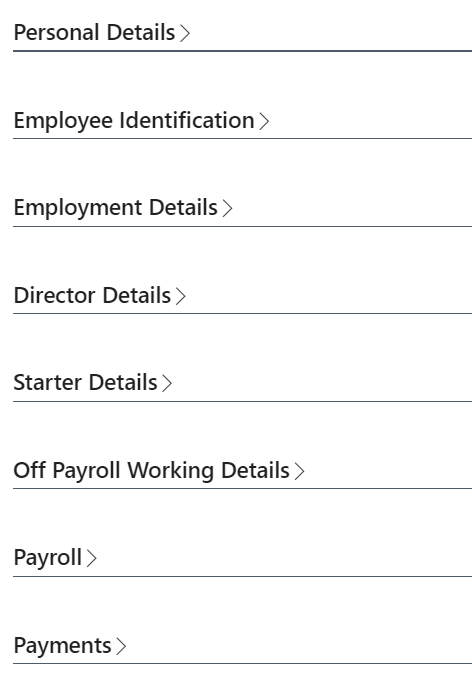

How much data can I hold about each employee?

- General information

- Picture & Attachments

- Address information

- Employment information

- Personal information

- Payroll information

- Payment / banking information

- HMRC starter / payroll information

- Confidential information

- Absences

- Contact

- Qualifications

- Reporting Dimension

- Misc. Information

- Pay Elements

- Timesheet entries

- Car benefits

- Student Loan

- Worker locations

- Plus, can configure more areas if needed

Once I once submit the monthly reports to HMRC does the payroll solution integrates with BC?

I currently pay uplifts to consultants and pay holiday entitlement based on these uplifts. Currently this is a manual calculation in Excel, is it possible to do these through SiriusPayroll365?

How does SiriusPayroll365 work from on-premise version of Dynamics NAV/BC?

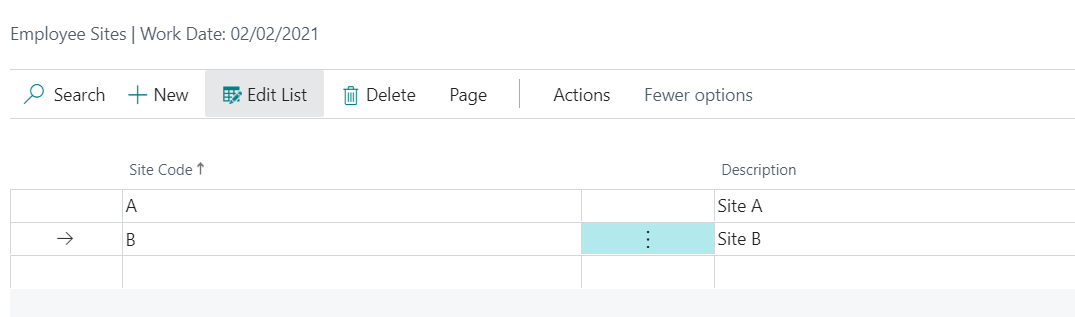

- Data extraction from OnPrem: Employee, Dimension, Chart of accounts

- Data Import and Configure on SiriusPayroll365 OnCloud

- Prepare and Post Payroll on SiriusPayroll365 OnCloud

Export Data from SiriusPayroll365 OnCloud and Import to Dynamics NAV/BC as Journals

Here are the steps you will need to follow to make sure SiriusPayroll365 works for on-premise version of NAV/BC:

STEP 1: Set-up BC Cloud

- Business Central SaaS is configured in the Cloud.

- You should have access to duality rights with the new CSP licenses.

- If not, you will need 1 BC essential CSP license.

- Install the Sirius Payroll 365.

Step 2: Set-up Core Data

- Extract Chart of Accounts from Dynamics NAV

- Extract Dimensions

- Extract Employee data

- Import into Business Central SaaS solution.

- We can provide services to support if needed. 1 day at £1,000.00

Step 3: Configure Payroll

- Configure Payroll Elements

- Configure Payroll Set-up

- Configure Employees

Step 4: Execute Payroll

- Create a payroll batch

- Set-up payroll

- Approve Payroll

- Export Payroll Journals via BC App

- Import Payroll Journals to Dynamics NAV On-Prem as General Journal

- NOTE: App available in March 2021 for all NAV versions.

- Can be manually done in the meantime if needed by support

On-Going

- Review Employees

- Repeat step 3 & 4 each month

Does SiriusPayroll365 support P11D ?

When are the payroll ledger entries created? Do you just post them?

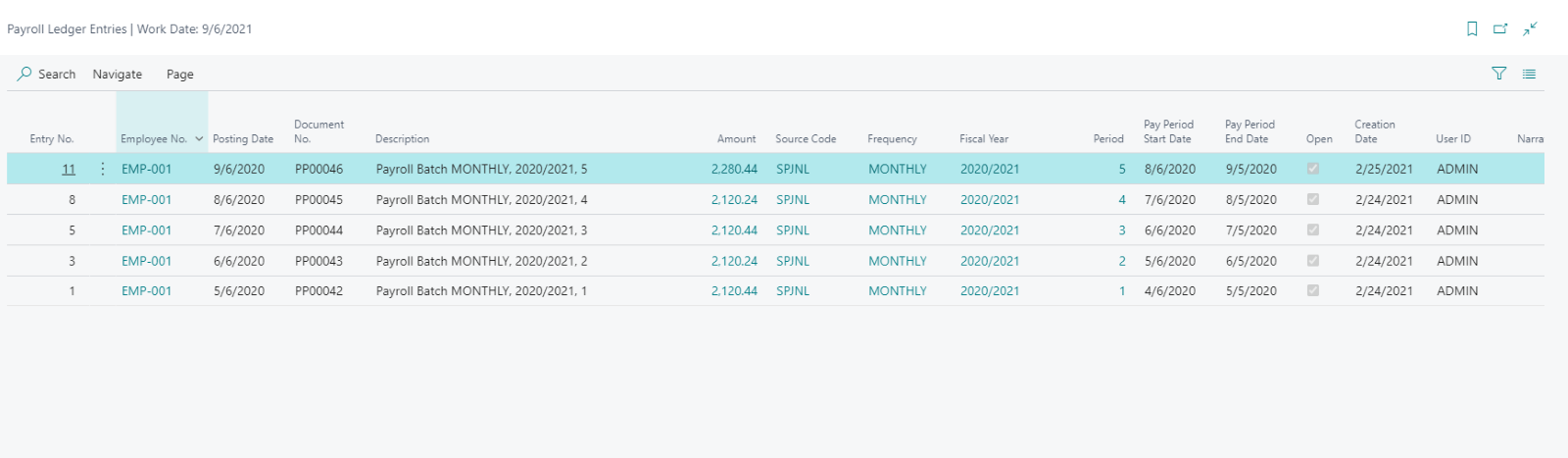

- When you create and post payroll batch, it will automatically create the payroll ledger entries, employee ledger entries and general ledger entries.

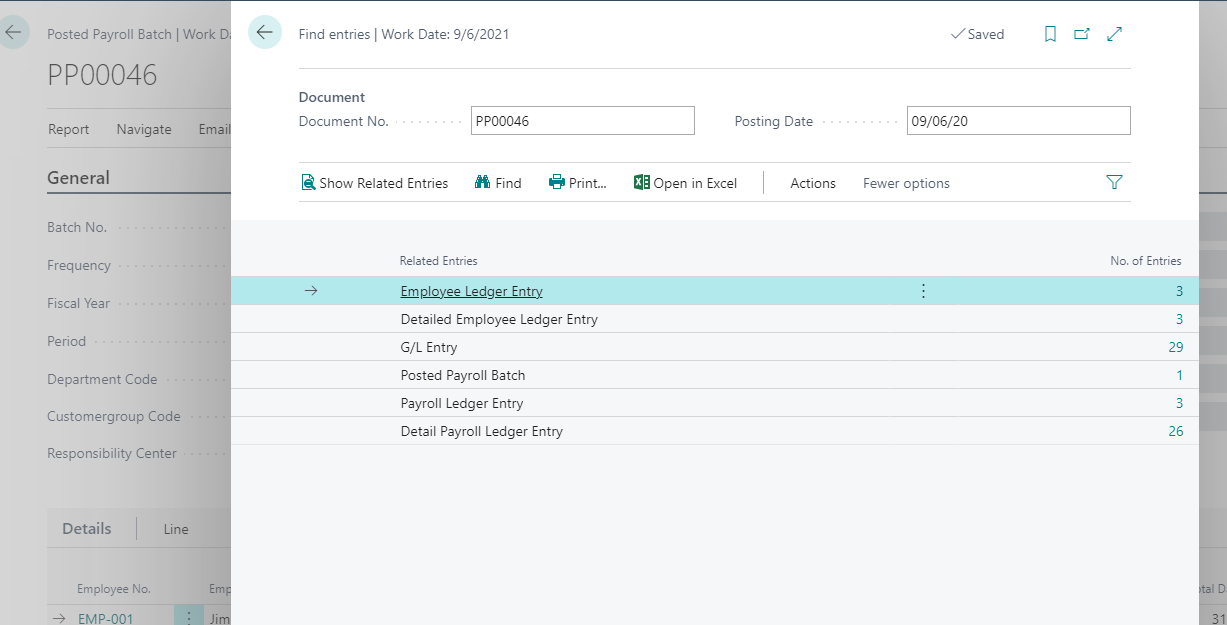

- You can navigate to the ledger entries by clicking on the “Find Entries” action in the “Posted Payroll Batch”

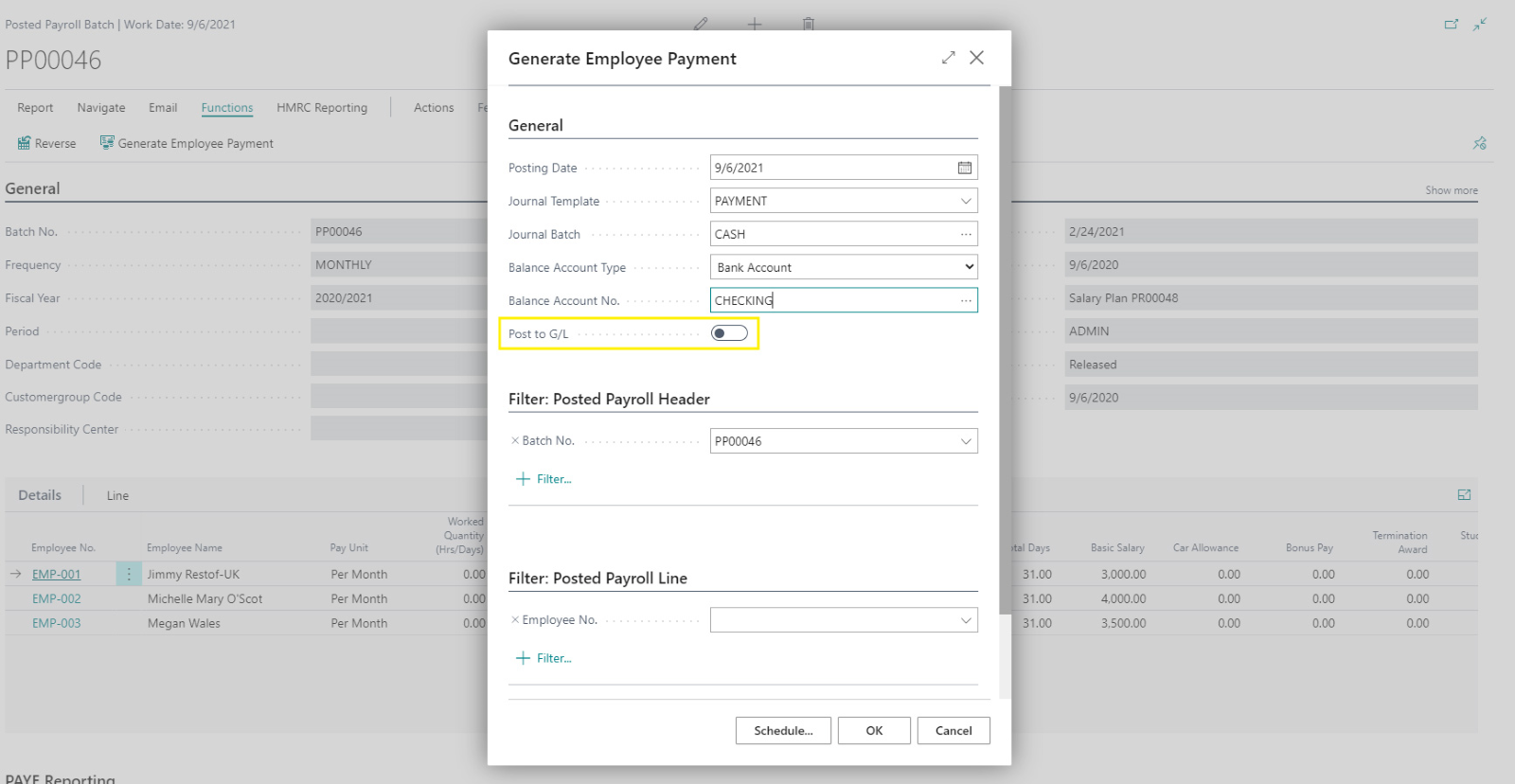

- Then fill in the required details as show in the below screen shot. Then click on “OK”.

- It will create the payment journal of all the employees posted in the selected Posted payroll plan.

- If you want to directly post it to general ledger entries then enable “Post to G/L” else if disable it will only create the journal lines.

Does SiriusPayroll365 create payroll payment journals?

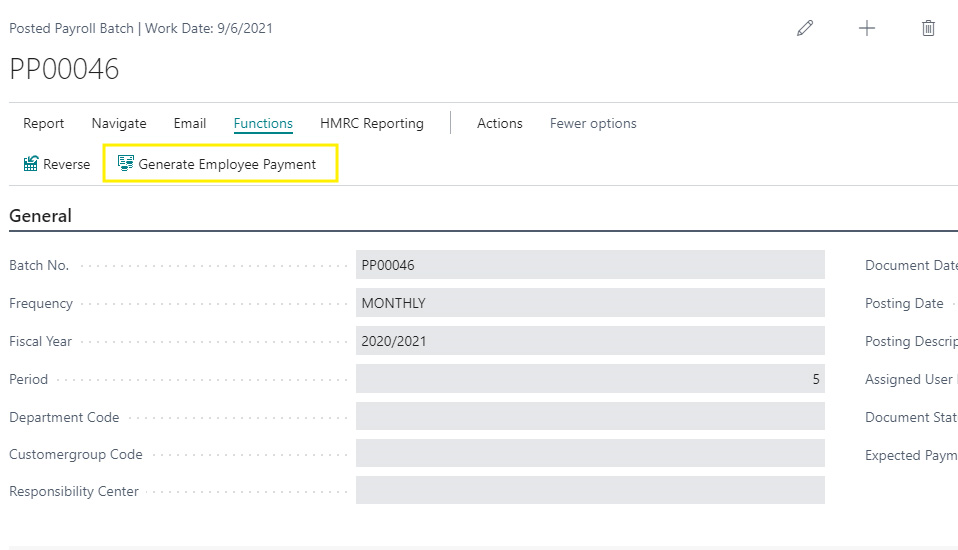

- Yes, you can create payment journals automatically for employees and you do not have to enter it manually.

- For this go to posted payroll batch and click on “Generate Employee Payment” action.

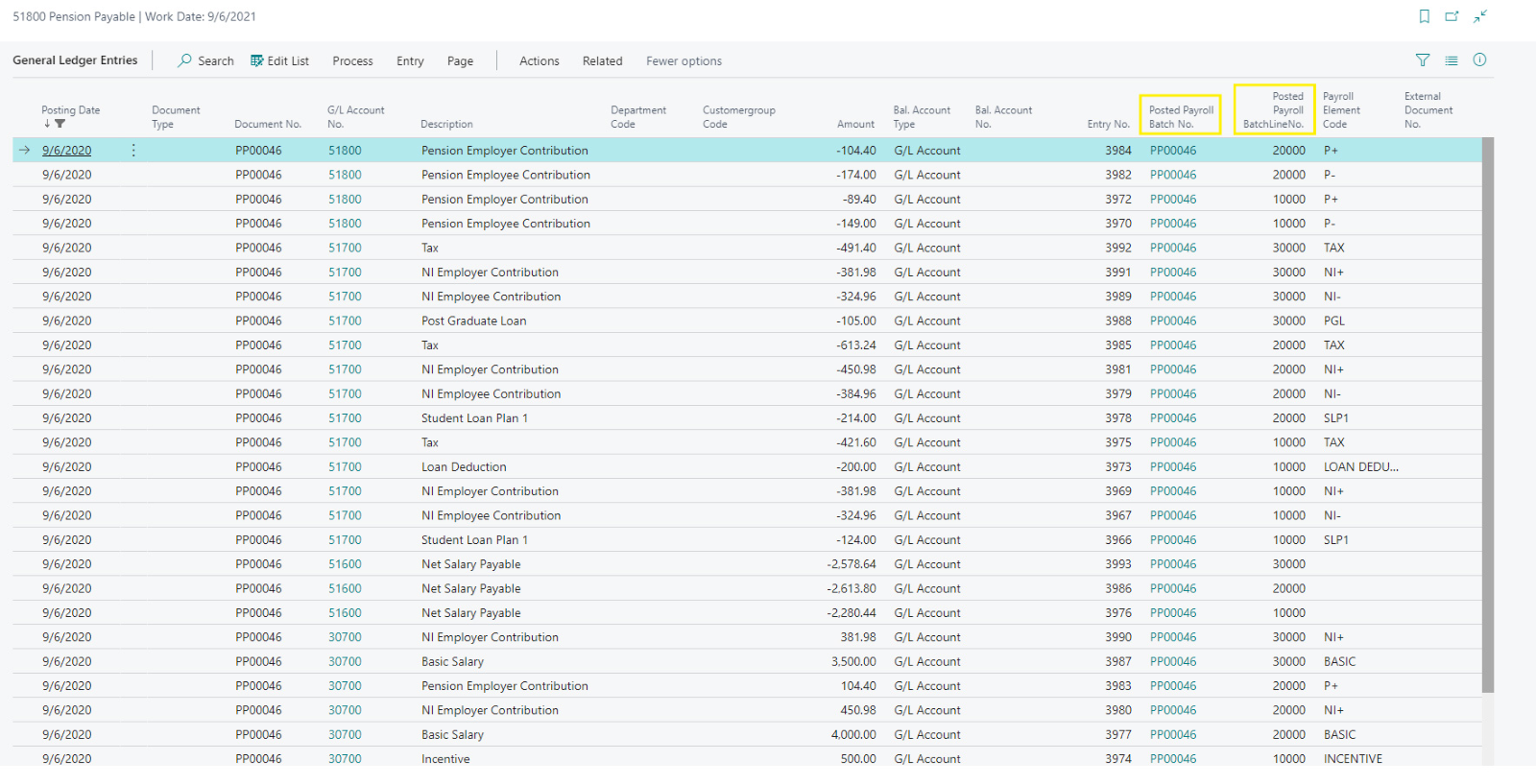

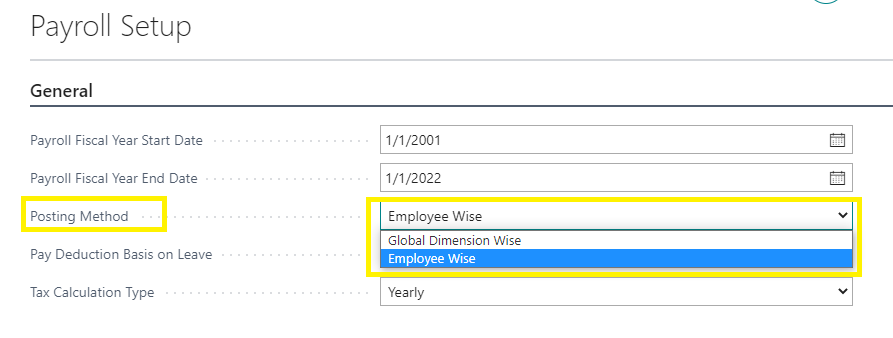

Does SiriusPayroll365 create one total entry or multiple for each person in general ledger entries? i.e., can it be tracked from a reconciliation point of view?

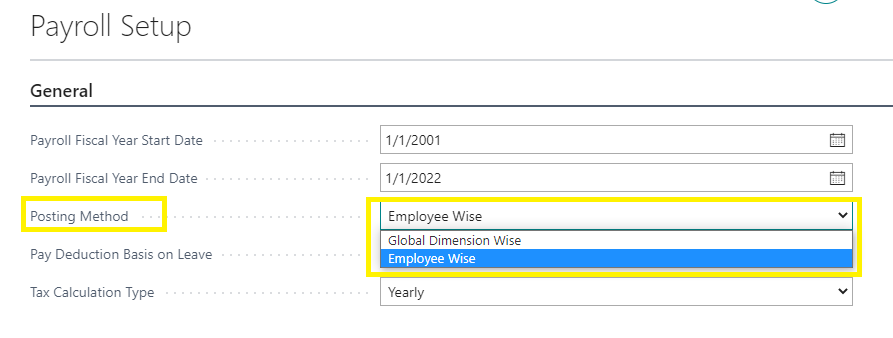

- We have a setup to control whether you want to post payroll to general ledger as a summary or as a detail. If you enable detail posting, you can track each element per employee in the general ledger.

- IF “Posting Method” is “Employee wise” then, it will post G/L entries per employee. We can track it by using Posted Payroll Batch No. and line no. in the G/L entries.

What are the tasks that needs to be followed on Payroll Ending Period?

Do additional earnings appear on the payslip?

- Yes, the additional earnings will appear in the payslip

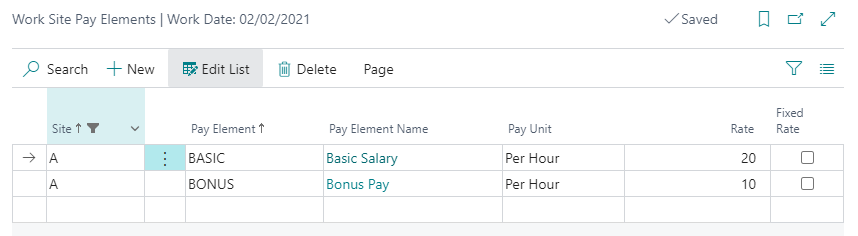

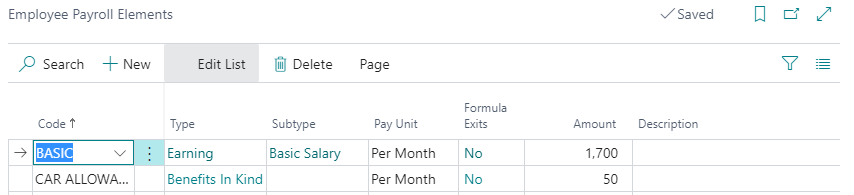

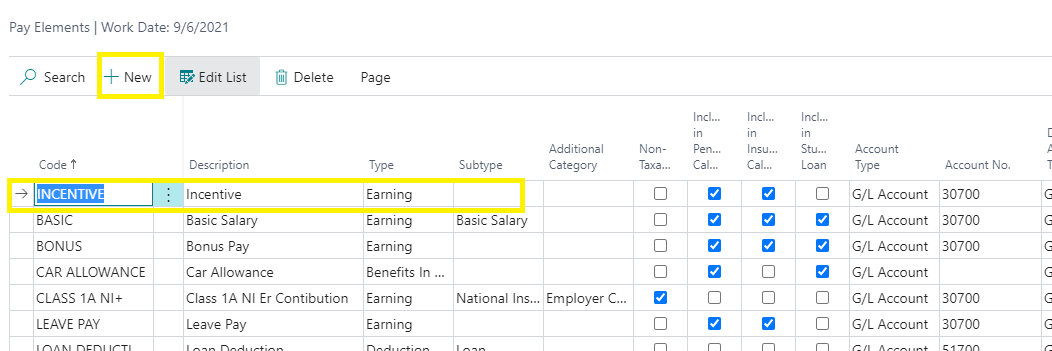

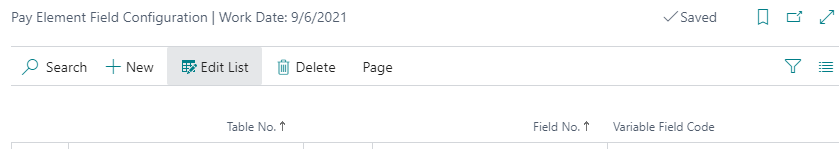

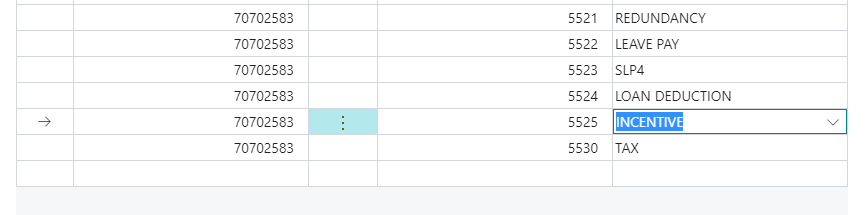

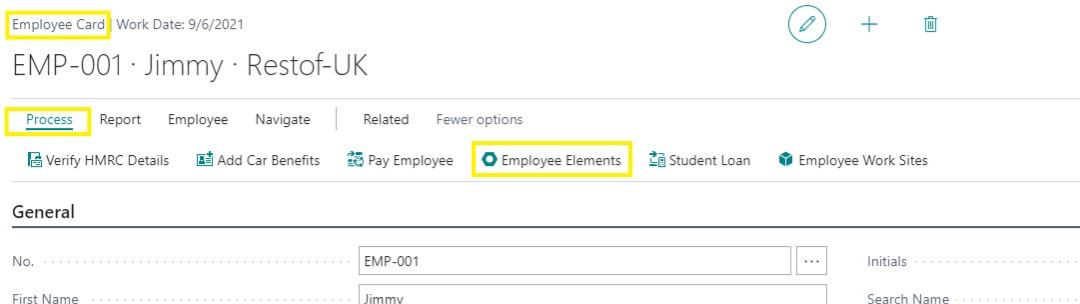

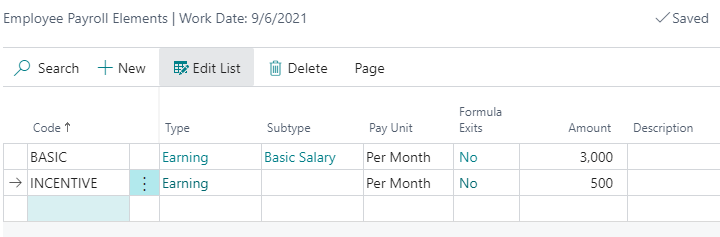

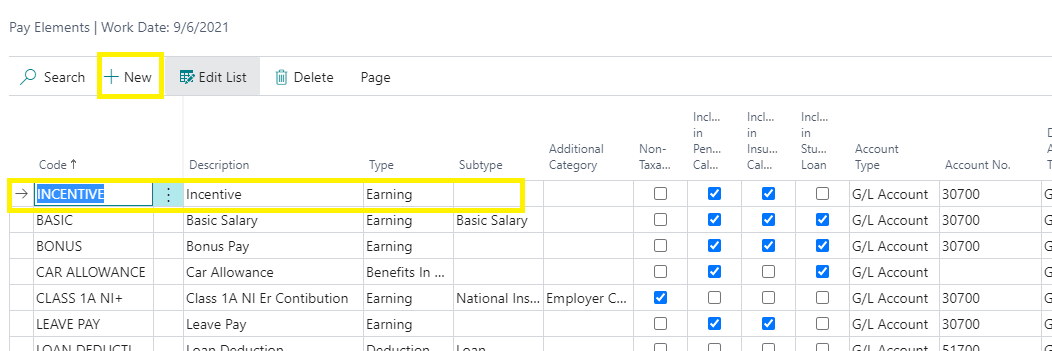

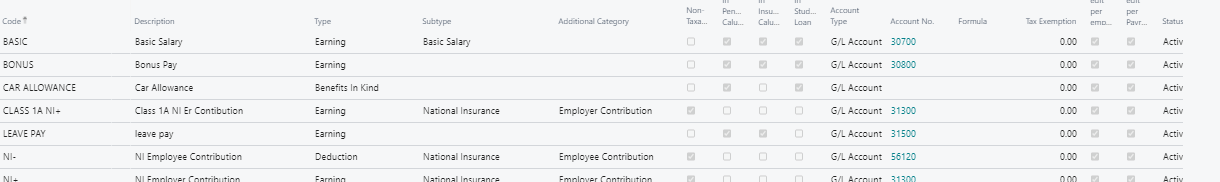

- For this you must add additional earning or benefits in the “Pay Elements” setup as show below. Then setup “Type” as Earning.

- The configure it in “Pay Element Field Configuration ” to appear in the payroll batch.

- Then add the pay element and the rate in the employee card.

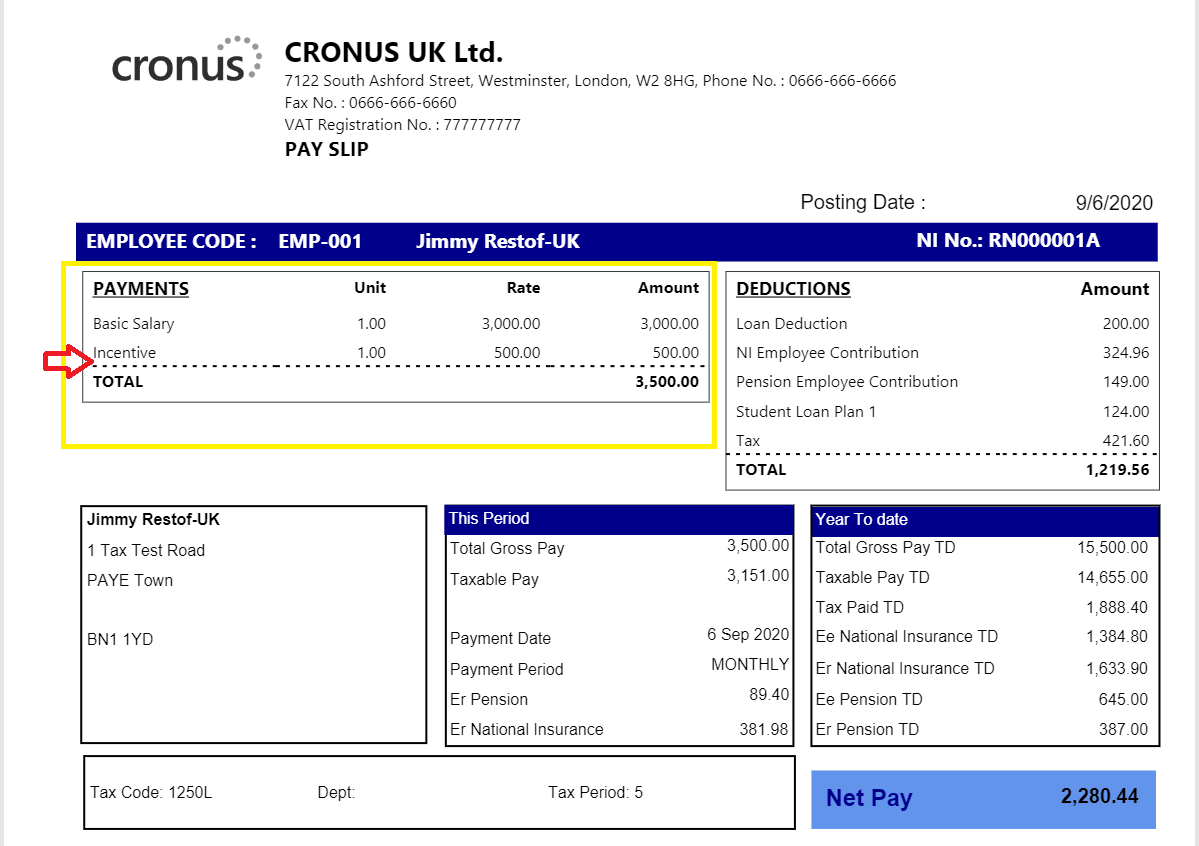

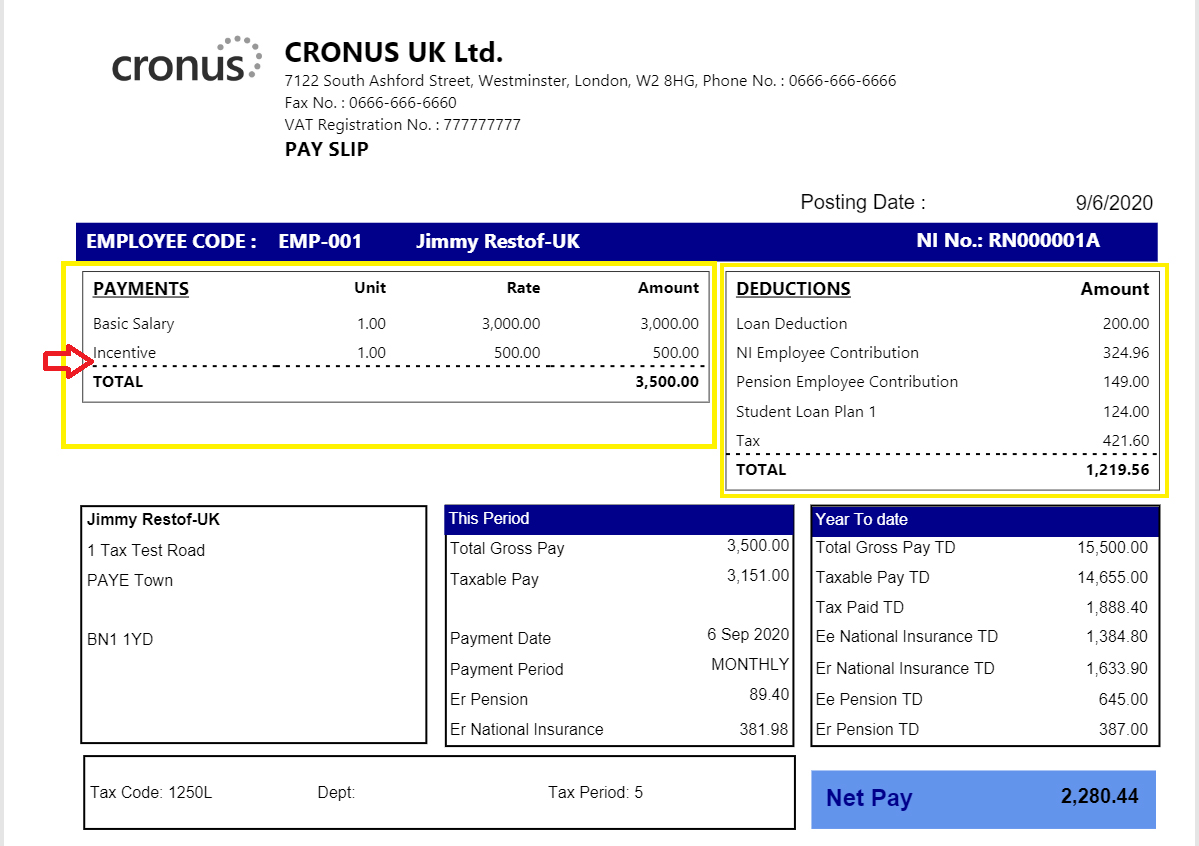

Then, after the payroll is processed and posted then it will appear in the payslip as show below in the in the payment section.

Then, after the payroll is processed and posted then it will appear in the payslip as show below in the in the payment section.

Do additional deductions appear on the payslip?

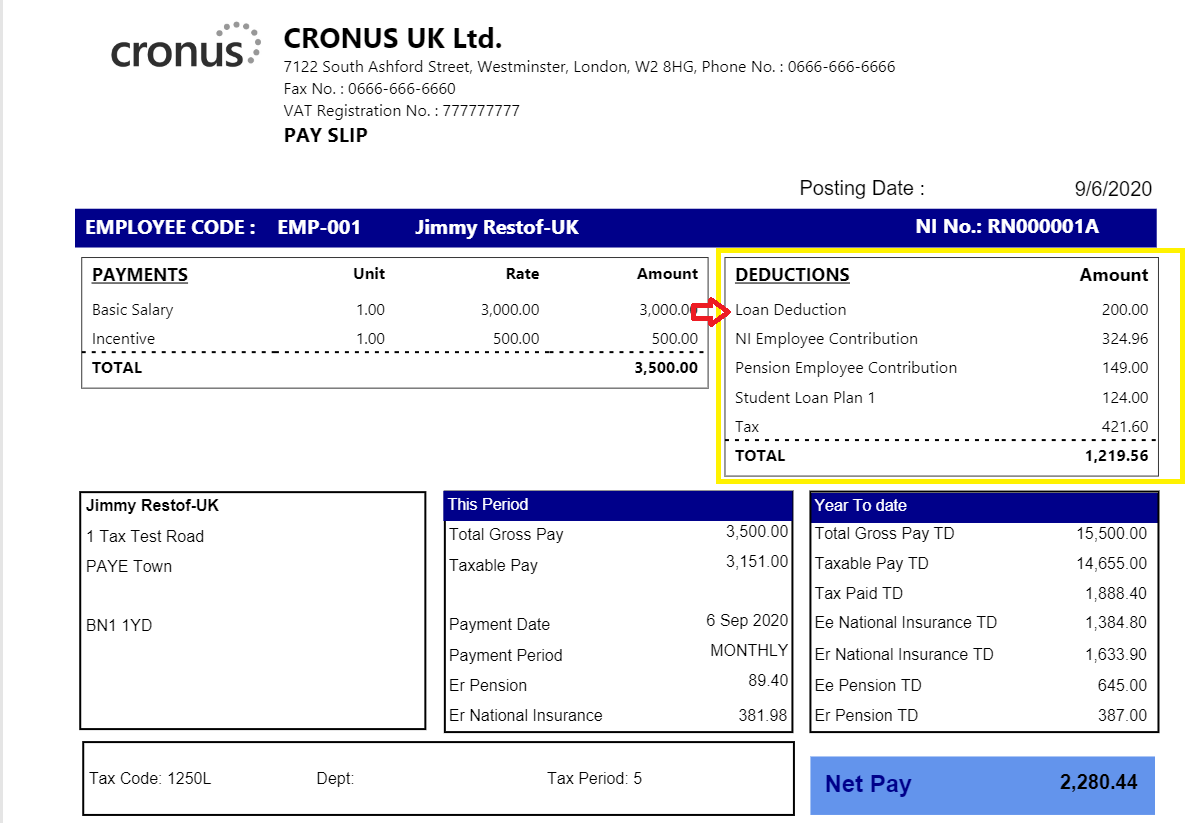

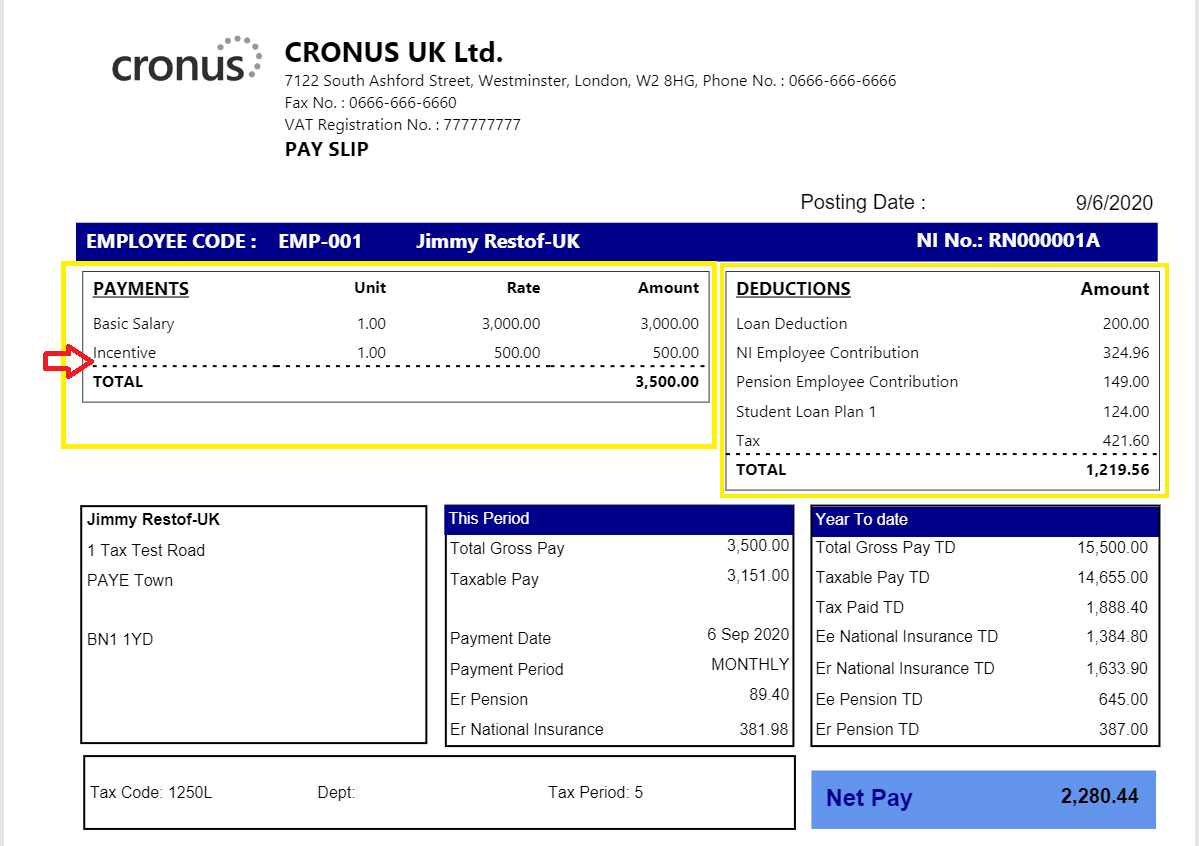

- Yes, the additional earning will appear in the payslip.

- For this you add it in “Pay Elements” setup and configure it similarly as we configured additional earning. But the “Type” field in the “Pay element” must be setup as deduction.

- Once it is configured and then process the payroll batch and post it. Then it will appear in the deduction section in pay slip as shown below.

Can employees access payslips? Can employees have a login of some form to view historic Payslips?

How many pay elements can be displayed on the payslip ?

- There are no limitations to the pay elements that can be displayed on the payslip

- So, you can add benefits and deduction as done in point no. 15 and 16 (above)

How many deductions can be displayed on the payslip ?

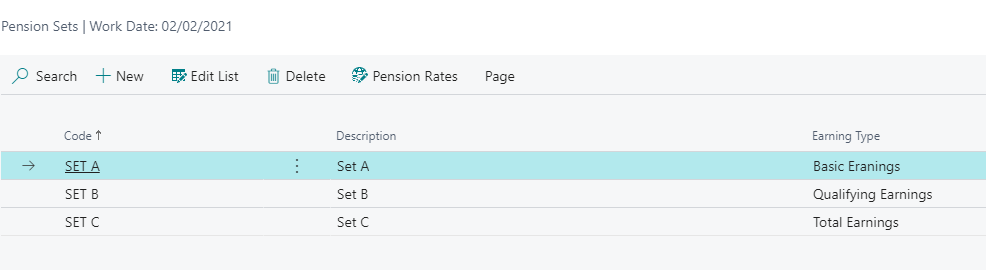

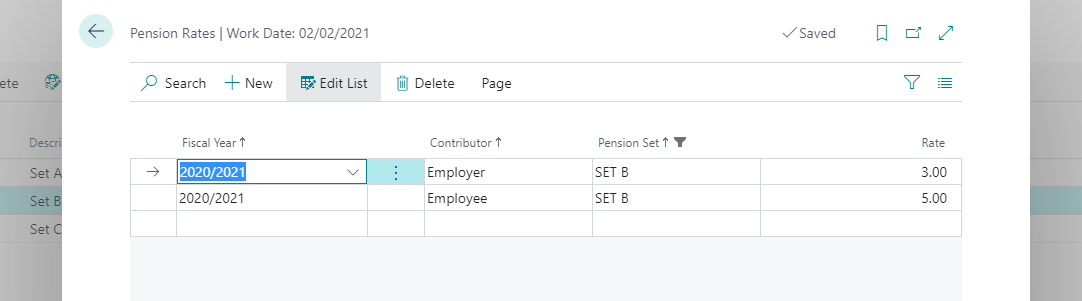

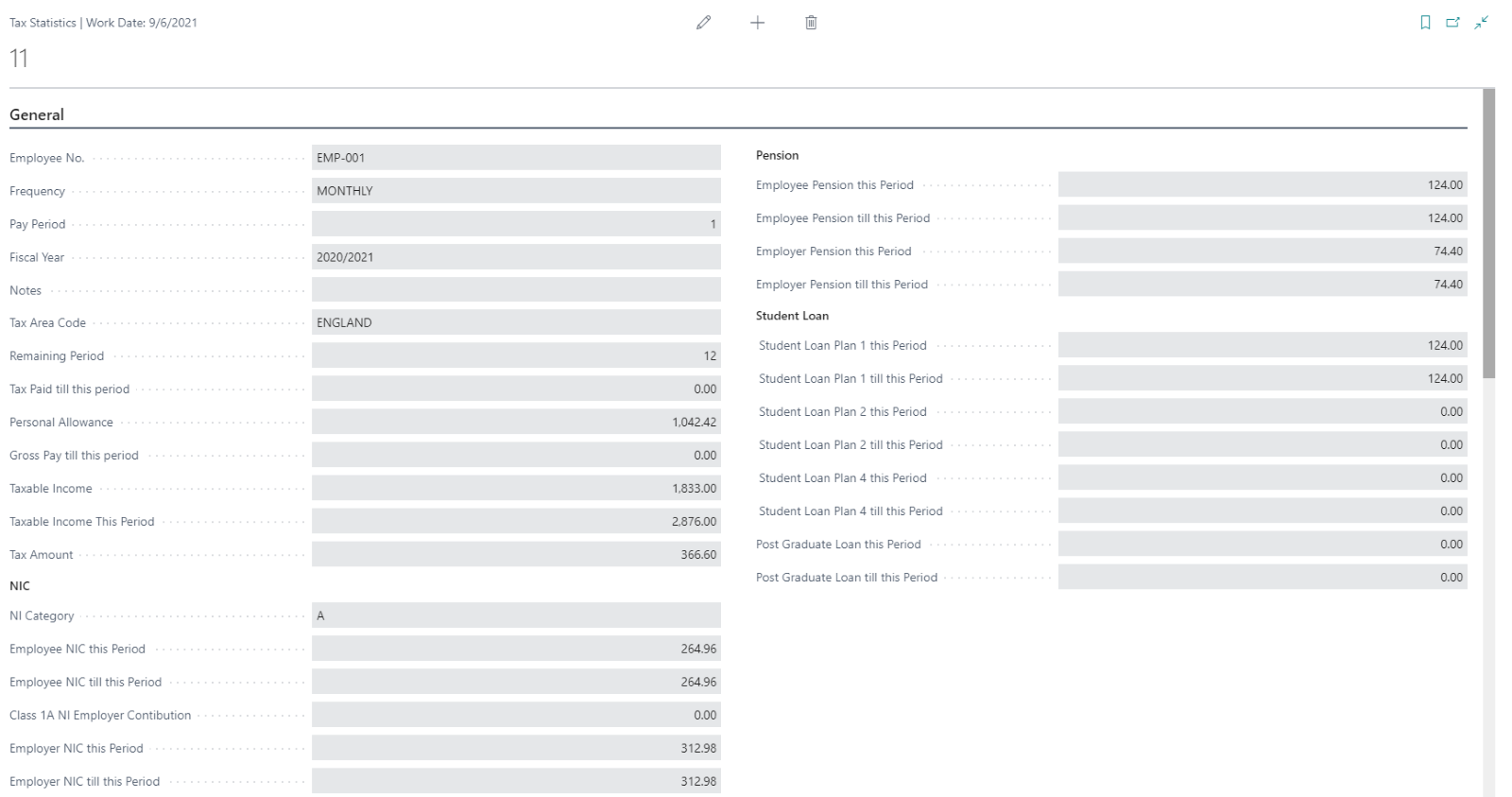

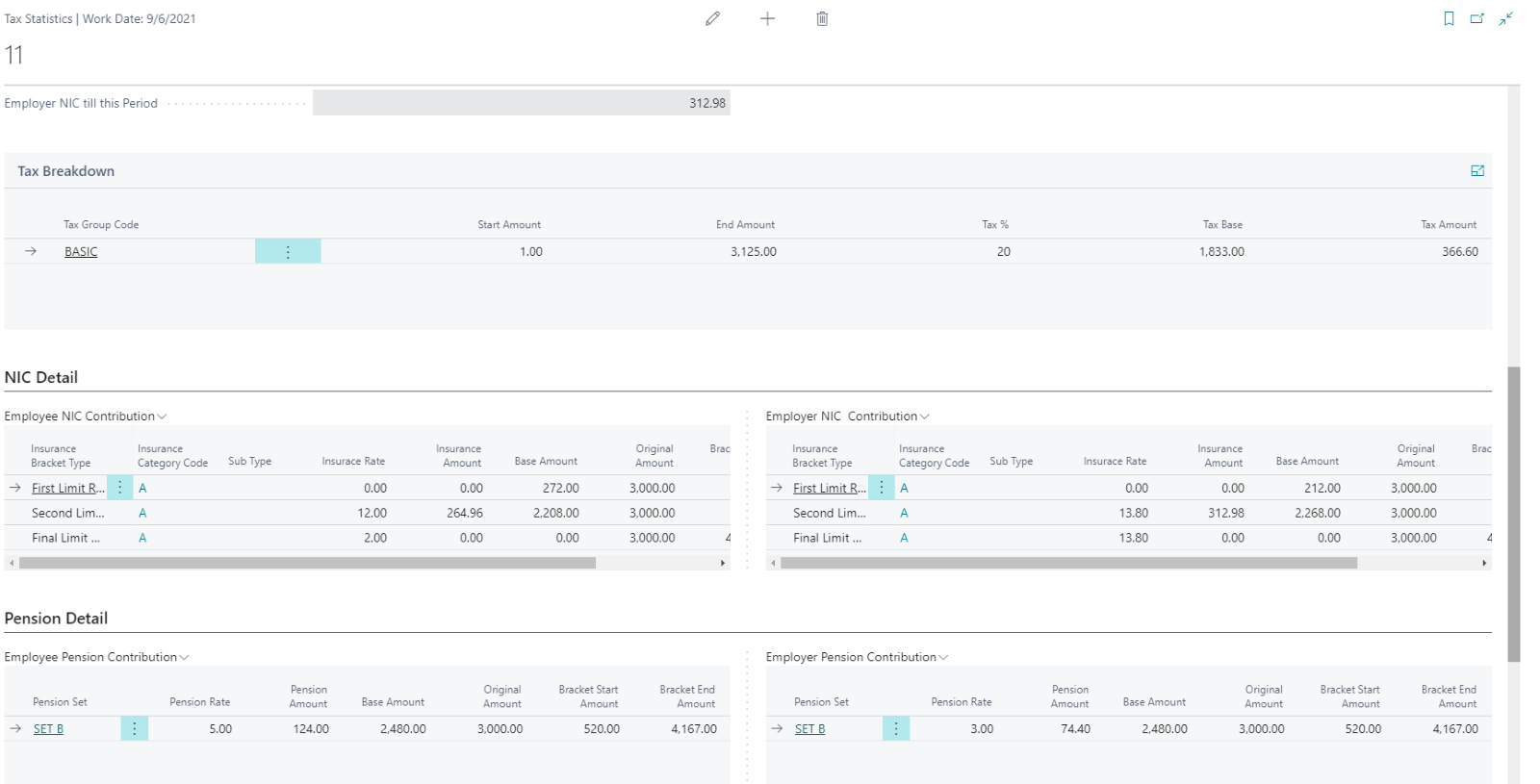

How are pensions calculated? Does it calculate the 3% or 5% automatically?

What if I need a pension provider extract?

The pension amount payables created by each pay run and subsequent BACS payment made to pension providers can be extracted from general ledger entries or Vendor ledger entries or both.

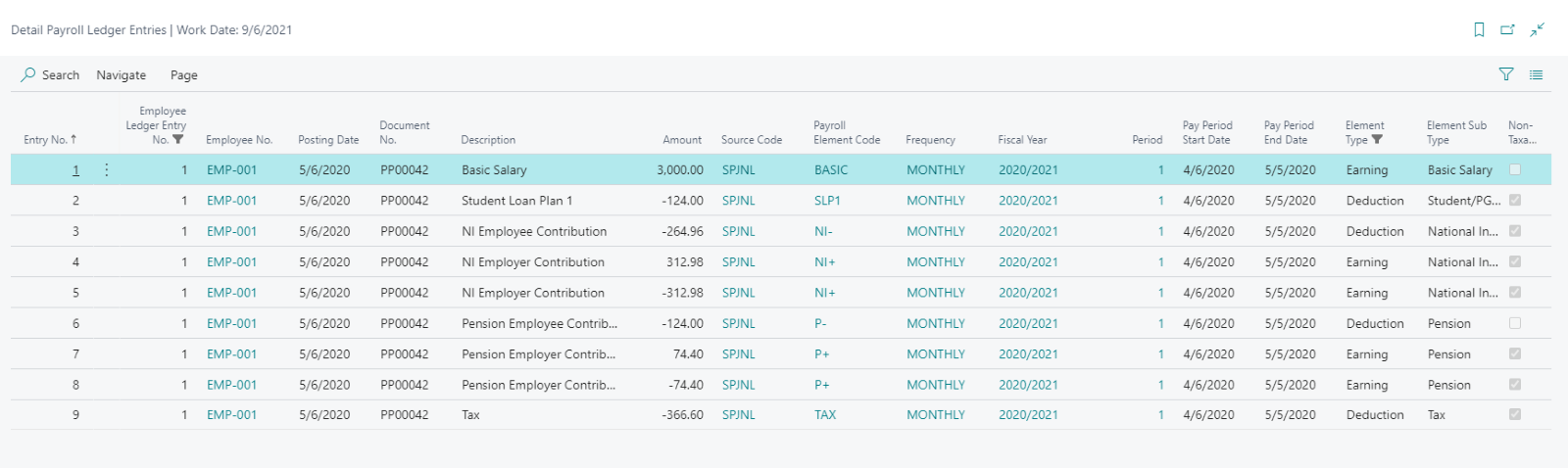

You may want to deep dive into Payroll detail Ledger entries to find out the pension amount (employer contribution and employee contribution) per employee of any payroll period.

How do you hide salary information from booker keepers?

How are expenses shown in the account side ?

On completion of every pay run, payroll journal is created in the ERP to debit payroll expenses and credit payables liabilities i.e. PAYE, NIC, Pension, Salary payables, Student Loans etc.

What reports are available out of the box ?

- Employee Pay slip

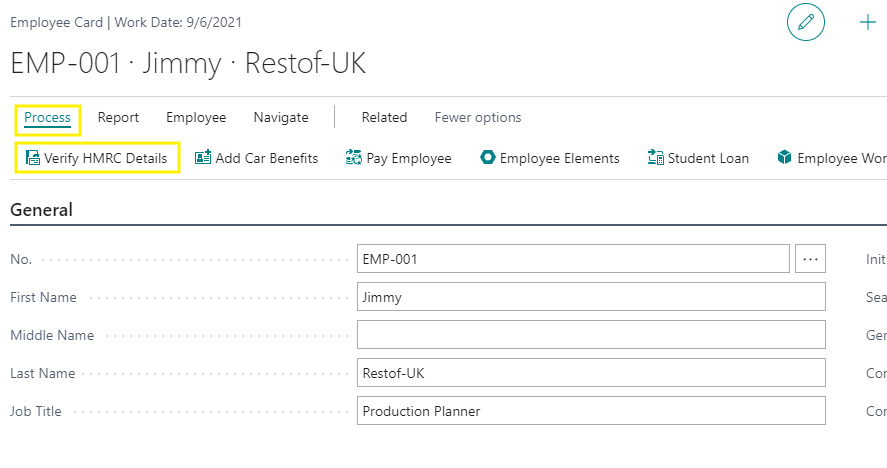

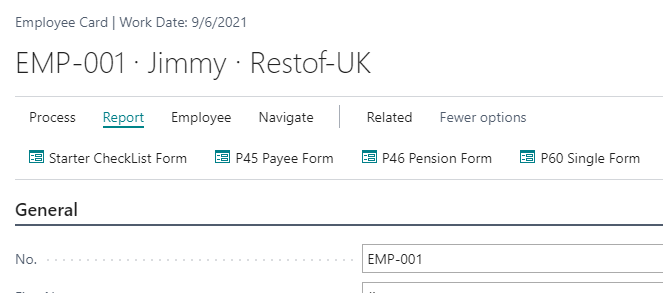

User can print the HMRC related forms from employee card.

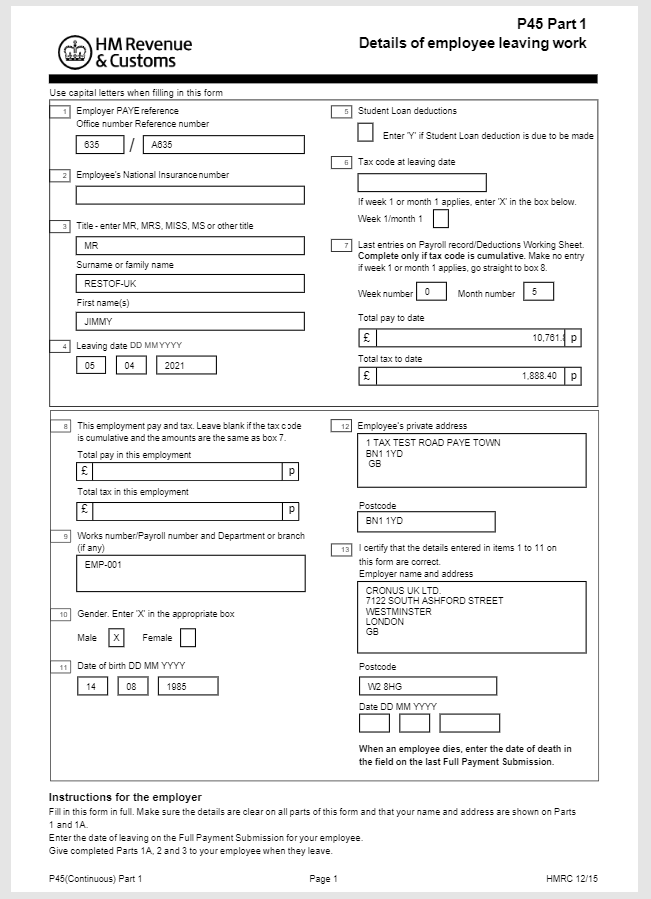

- P45

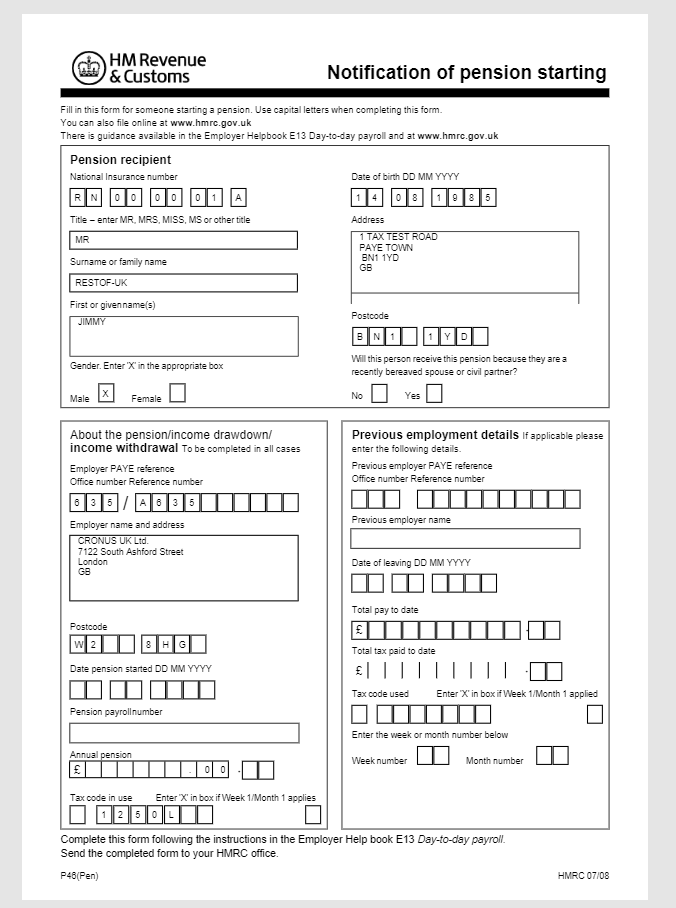

- P46

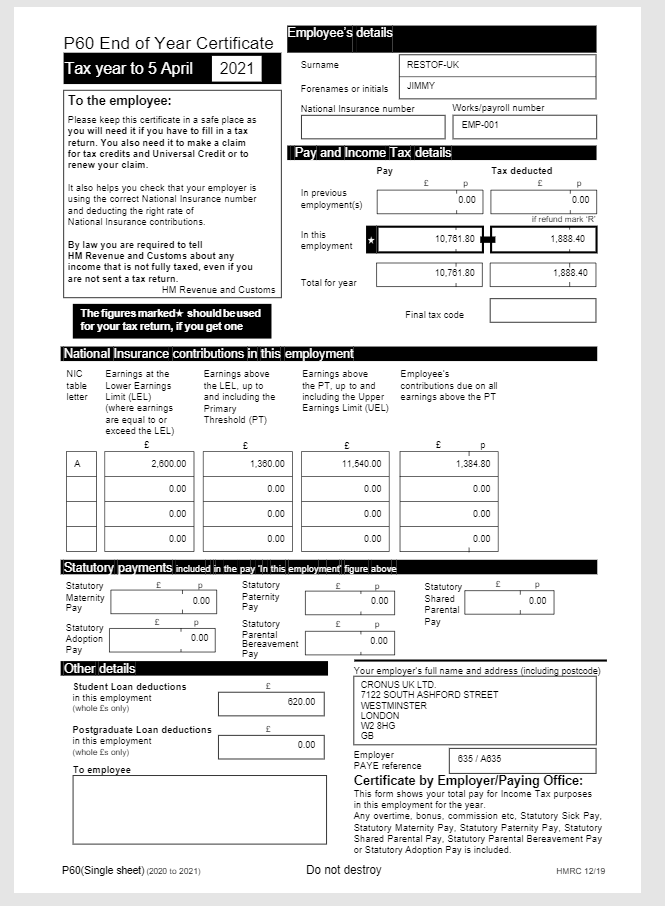

- P60

User can view the payroll statistics and ledger entries from employee card as well.

- Payroll Ledger and Detail Ledger entries

- Employee Payroll Statistics

Can you enter timesheets?

How do you map timesheet entries to payroll elements?