Why you need an HMRC payroll software

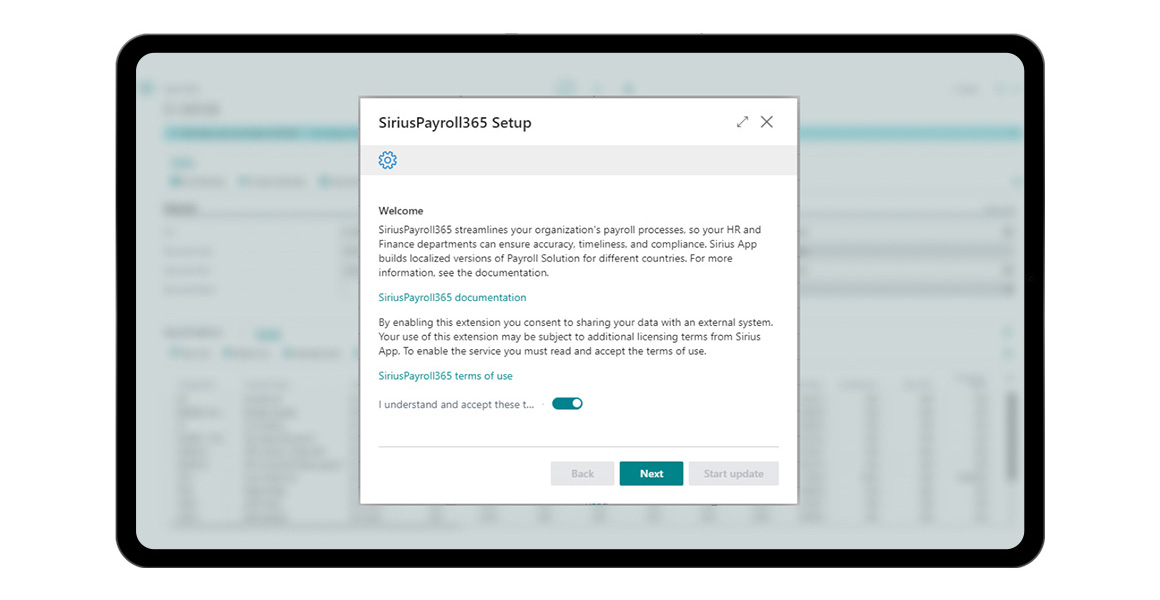

Payroll management can be a complex and detail-oriented process. Archaic methods of payroll management involve the need to handle tons of paperwork and are inefficient. Data can get scattered across your organisation, causing unwanted financial and reputational risks. SiriusPayroll365 is an integrated business central HMRC recognised payroll software for UK that streamlines your payroll processes, so your HR and Finance departments can ensure accuracy, timeliness, and compliance.

Simplifies payroll management and processing:

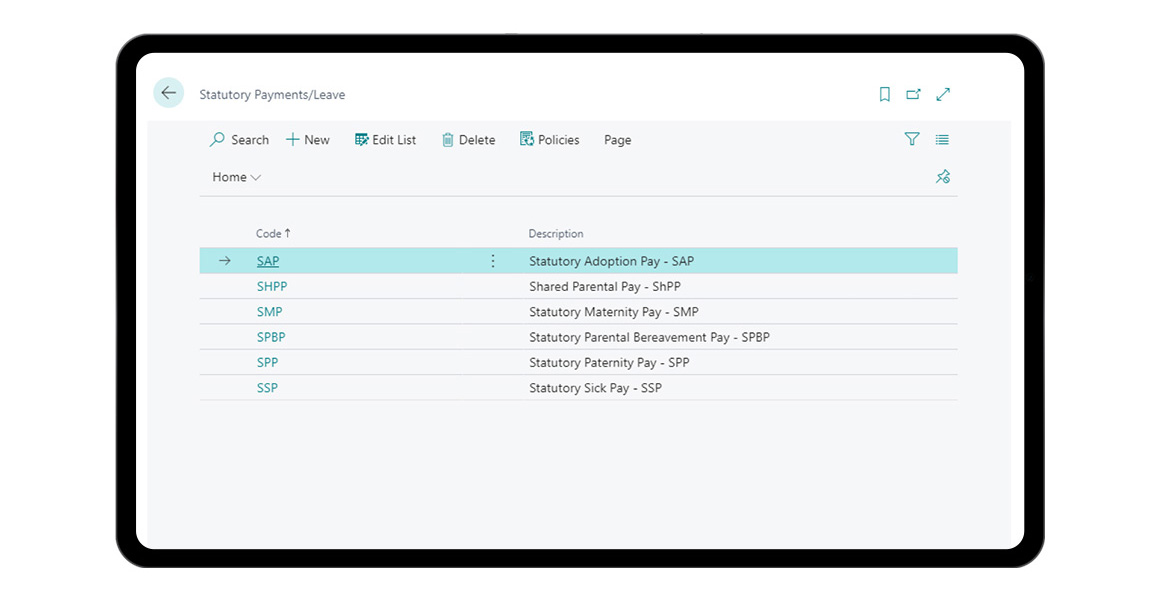

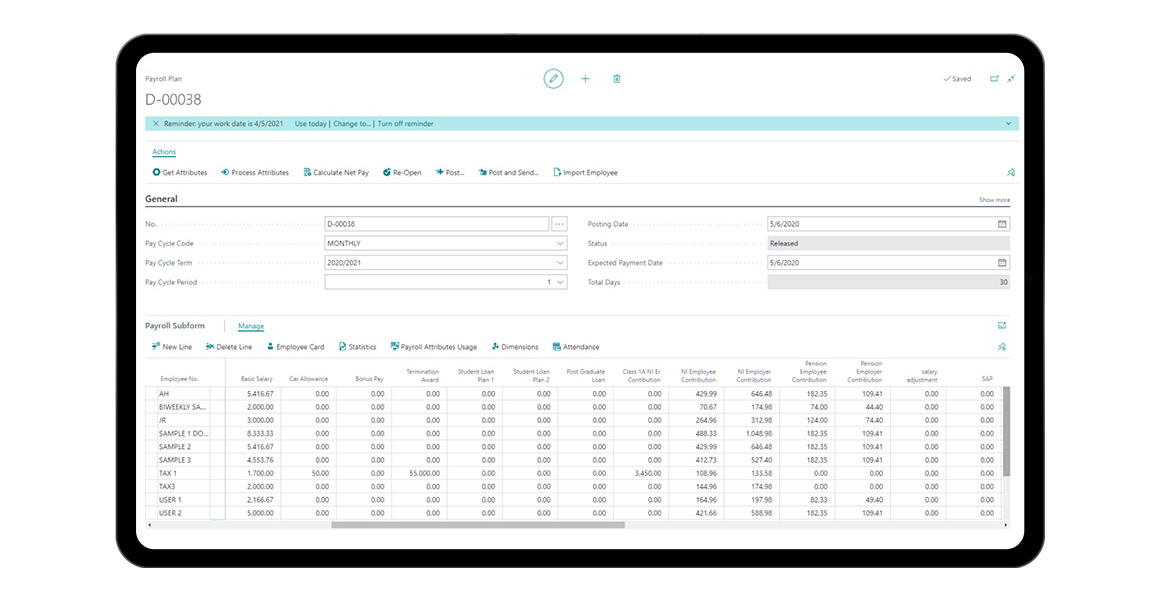

Traditional payroll systems leave HR and Finance professionals with a lot of manual processes in processing payroll, filing taxes, and reporting job cost. SiriusPayroll365 is an ERP payroll that automates manual paperwork and reduces human errors. It enables you to process payments regarding pensions, overtime, sickness, contracted hours, insurance, maternity & paternity, and more.

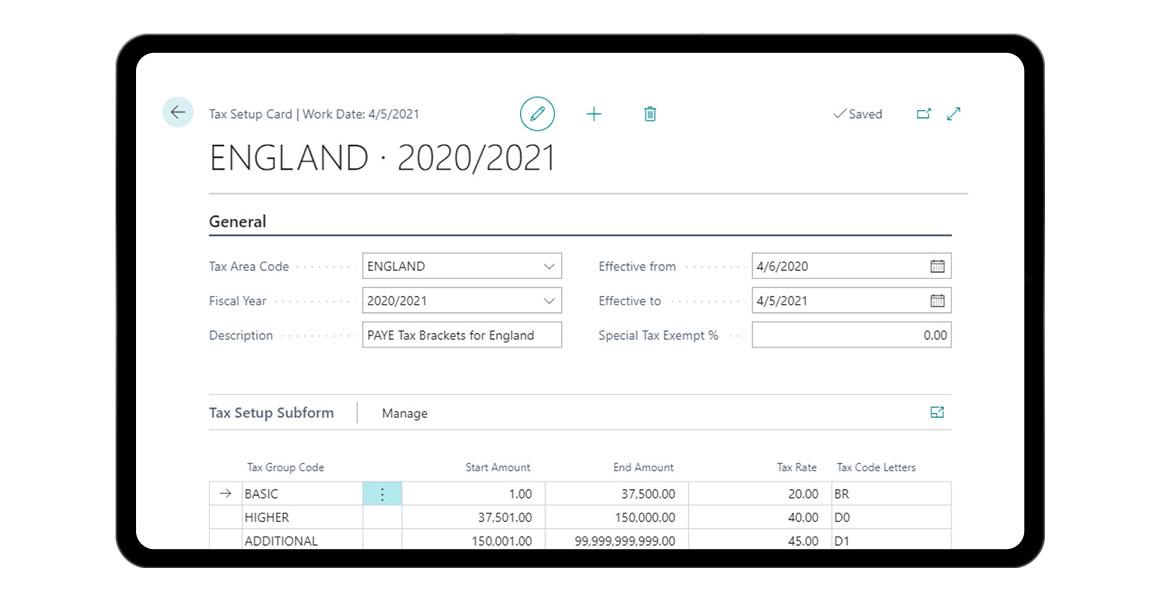

Keeps your organisation compliant with the legislation:

Compliance can be a big challenge in payroll processing. Our business central payroll solution ensures you submit the right data to HMRC and meets the RTI (Real Time Information) requirements. This means you can avoid common pitfalls and deal with pending payments on time.

Brings your payroll, financial, and employee data together:

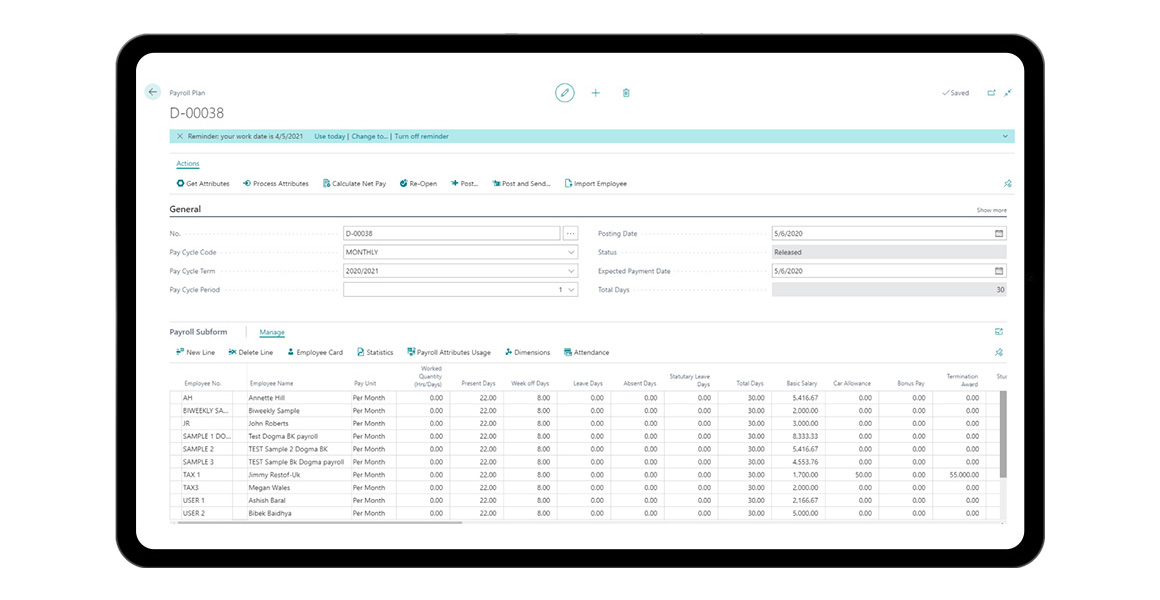

We have made payroll simpler by combining your finances and employee data in a single solution. SiriusPayroll365 syncs data with Dynamics 365 Business Central. This will allow your HR and accountants to centralise all the employee data, set up new employee accounts, and sync their salary information from a single solution.

Speed up your processing with cloud based payroll

Manage employees’ payroll from one place:

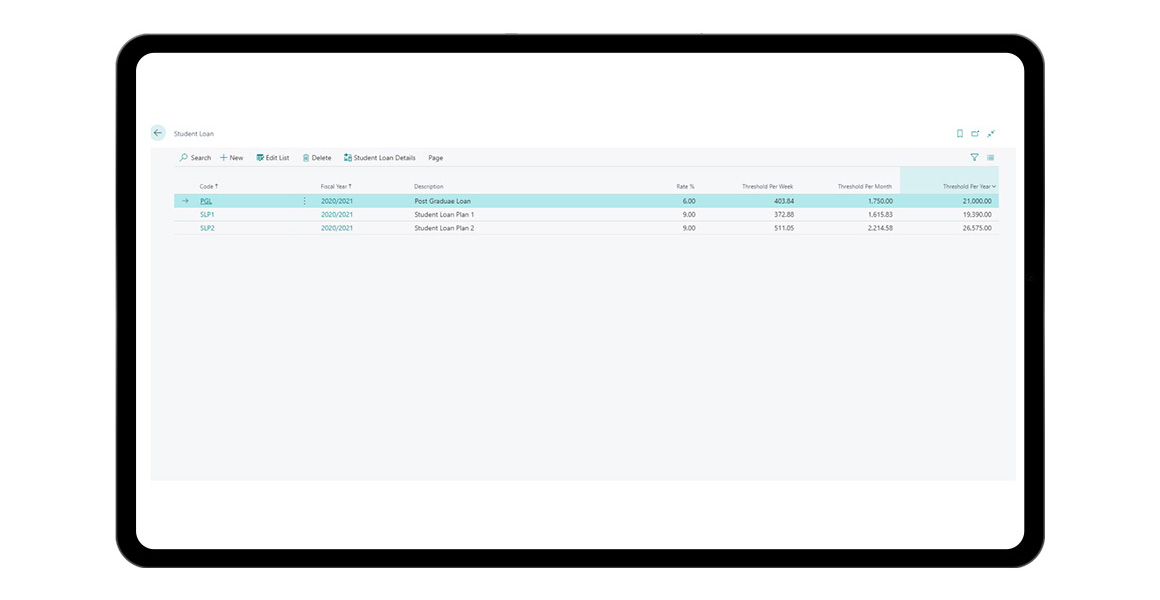

SiriusPayroll365 lets you collect, manage, store, and share your employee data securely. It holds details of staff pay and deductions including salary, NI (National Insurance), pensions, sickness, overtime, contracted hours, student loans, and other pay & deductions. As our solution is hosted on Microsoft Azure, a leading cloud platform known for its advanced security measures and infrastructure, you can rest assured that your sensitive payroll data is stored within a highly secure environment.

Send online payslips to employees:

You no longer need to calculate payment and print payslips manually. Our HMRC payroll software creates accurate and compliant payslips, P60s, and other payroll reports. You can email the password-encrypted payslips to your employees each month. When you send a payroll, it is initially saved as a draft where you can make changes if problems arise, allowing for more efficient revisions in the occurrence of any errors.

Create accurate payroll reports:

Generate employee earning reports through Sirius Payroll 365. You can easily see when and how much your employees are paid, so you are always in control of your finances. This will also keep your organisation safe from penalties and regulatory issues. In addition, with the Year-to-Date release, you can determine the company’s financial health without waiting for the end of the fiscal year.

Automate complex legislation with HMRC payroll:

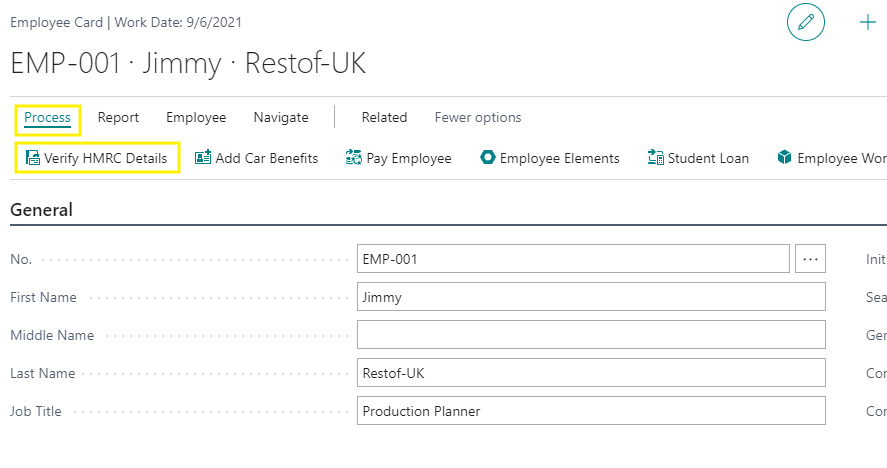

Using SiriusPayroll365, you will be able to reduce errors and eliminate manual processes in HMRC reporting. The solution connects to HMRC and retrieves tax codes automatically. Our application is HMRC recognised payroll software, which ensures that your payroll is legally compliant.

Manage your finances with Dynamics 365 Business Central integration:

All your payroll data will be hosted in Dynamics 365 Business Central. SiriusPayroll365 captures data from Business Central and enables complete payroll processing. You can see the information on employee salary, pensions, statutory payments, and deductions. It also lets you print cheques, which you can send directly to your employees.

Manage your people with Dynamics 365 HR integration

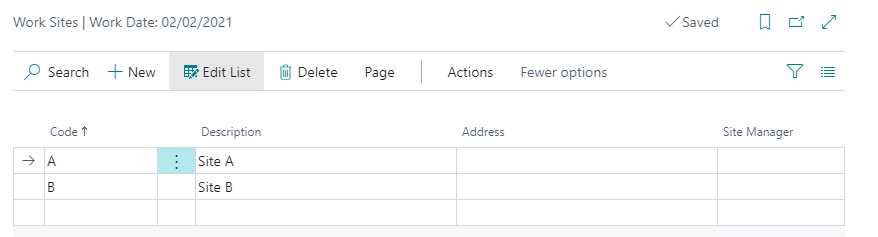

By integrating our solution to Dynamics 365 HR, you can unlock the full hire-to-retire cycle for your employees effectively. You can set up new employees, create benefit plans, and manage appraisals and performance review models. In addition, the timesheet will enable you to manage payroll by tracking the time each employee worked during a given period. With its principal usage for payroll, your organisation can ensure the accurate payment of employees.

Automate your P11D submissions:

SiriusPayroll365 supports the preparation of P11D forms. Our HMRC-recognised solution ensures the documents produced are fully compliant, creating a comprehensive payroll package. In addition, it helps to calculate the benefit cash equivalents, allowing you to run P11D reports without any manual hassle. You can then submit it directly to HMRC via the secure gateway making P11D submissions a breeze.

Multi-Currency, Multi-Company Capability:

Managing a payroll process throughout several countries and regions, effectively handling conversions to accommodate varied reporting structures and other legal compliance, is time-consuming and error-prone. With our payroll software, you can now transact several currencies while tracking and managing them in real-time.

Simplistic UX:

Simple-to-use payroll processing makes it easier to generate periodically and automate the process of making adjustments. While working in payroll processing, you can access related and reused documents through a single tab, enabling you to perform work promptly.

FAQs

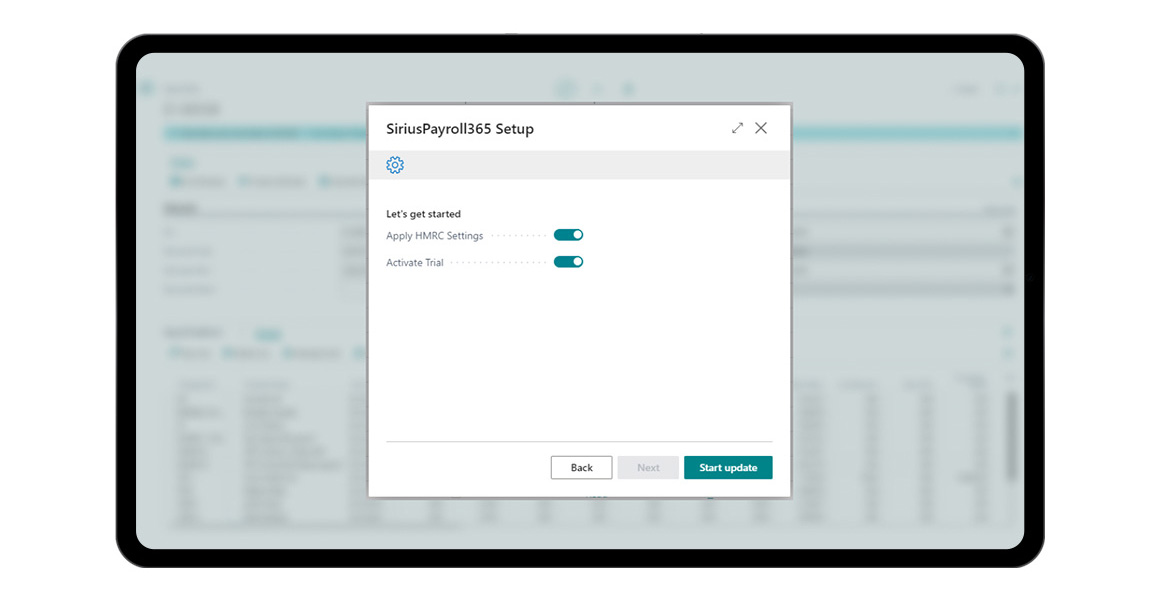

Q:How do I install SiriusPayroll365?

For more information you can view our setup guide.

For more information you can view our setup guide.

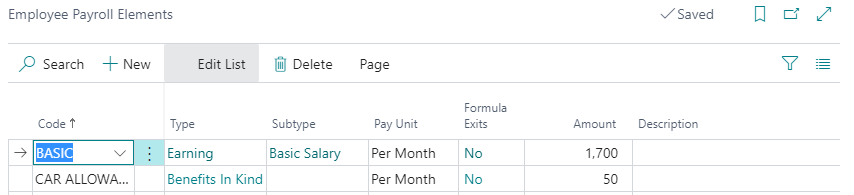

Q: How is Car allowance calculated?

Q:What is the cost per employee?

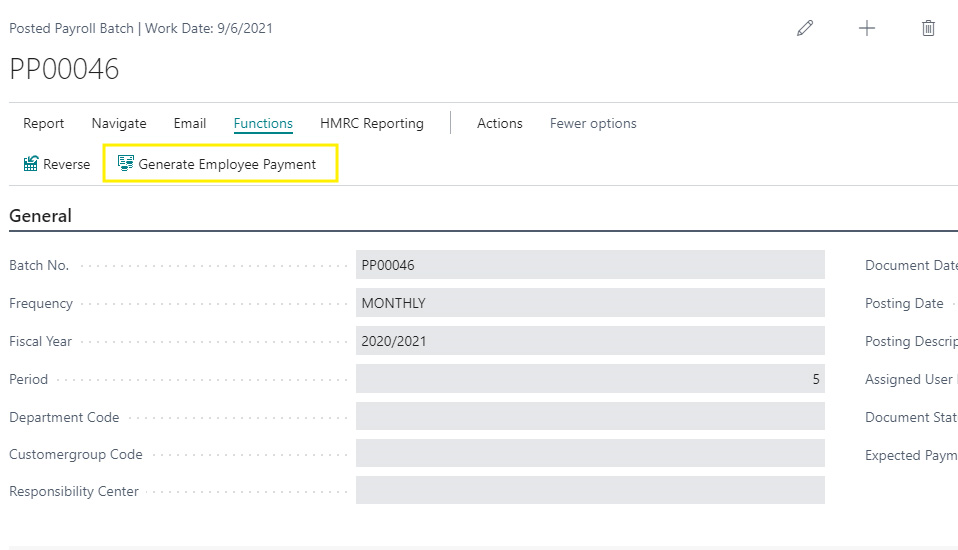

Q: Does SiriusPayroll365 create payroll payment journals?

- Yes, you can create payment journals automatically for employees and you do not have to enter it manually.

- For this go to posted payroll batch and click on “Generate Employee Payment” action.

Q: How do I auto enroll a new member of staff?

Q: Can you enter timesheets?

Get hands-on with these resources

Gallery

Get in touch

Getting started is easy. Our pricing is transparent and costs just £1 per employee, per month.

Get in touch with our team and see how simple payroll can be for your organisation!